More About ETF Investing: Why S&P 500 ETFs Have Become the Tail Wagging the Stock Market Dog |

| Site Information (is listed below. The financial planning software modules for sale are on the right-side column) Confused? It Makes More Sense if You Start at the Home Page How to Buy Investment Software Financial Planning Software Support Financial Planner Software Updates Site Information, Ordering Security, Privacy, FAQs Questions about Personal Finance Software? Call (707) 996-9664 or Send E-mail to support@toolsformoney.com Free Downloads and Money Tools Free Sample Comprehensive Financial Plans Free Money Software Downloads, Tutorials, Primers, Freebies, Investing Tips, and Other Resources List of Free Financial Planning Software Demos Selected Links to Other Relevant Money Websites

|

About ETF Investing

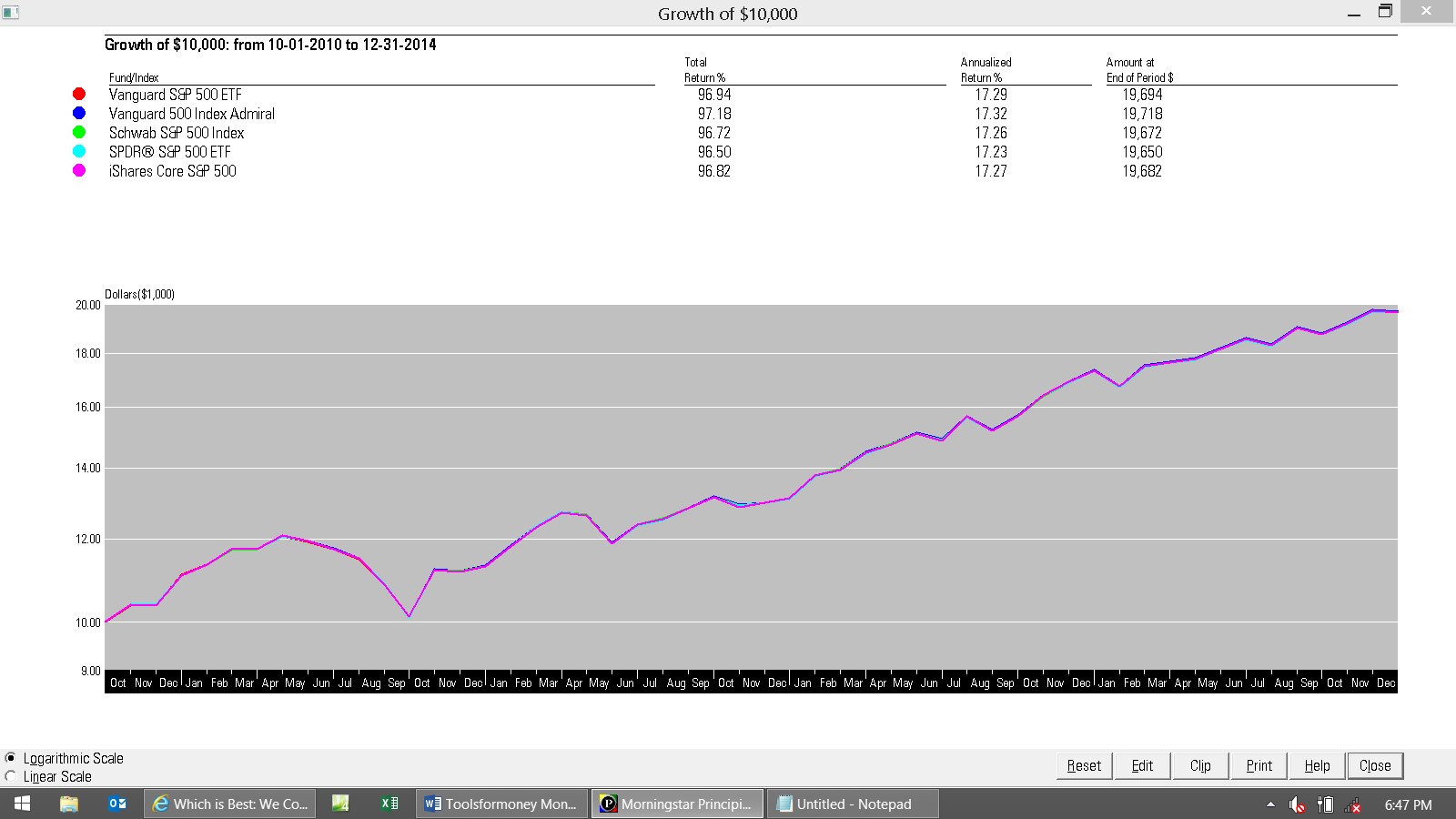

Text Below the Image is Old, But Still Relevant This is what's current: Data was finally compiled in April '16 to perform an objective analysis on the progress ETFs have been making. The results are here on a spreadsheet In March 2016, ETFs outperformed mutual funds in 60% of the 15 asset classes used in the investing Models. This number has only been over 50% once before. So it was viewed as an anomaly. But since then, the numbers have been slowly creeping upwards. So it's time to realize that ETFs have matured to the point that can be used as a viable substitute for mutual funds. Their performance is still "squirrely" at best, but over the same time frame the analysis was done, so were mutual funds. So before you make a fuss, know this: If the ETFs that beat the mutual fund picks were the same every month, then that would be something to write about. But still they crap out and need replaced more than mutual funds do. So at the moment, it looks like ETFs are the hare in the race with the tortoise. You still can't buy and hold most of them and expect it to outperform a buy and hold mutual fund. One month this ETF looks like it greatly outperforms the mutual fund. Then the next, the mutual fund wins, and another ETF looks like it will beat the fund. Then the next month, that ETF craps out too. So for the moment, it still looks like mutual funds are still the way to go with sane, rational, normal buy and hold investors practicing boring asset allocation techniques. Why? Here's some guesses: • First and foremost, in 2009, President Obama cracked down on Wall Street shenanigans, particularly hedge funds. When the most egregious offenders started being investigated, prosecuted, and convicted (usually for "insider trading"), most everyone stopped cheating immediately en mass. Since then, the days of superstar mutual funds consistently beating their benchmarks ended. The Model portfolios also stopped beating consistently the markets. • ETFs offered star managers more of dat Wall Street uber money to quit their jobs managing mutual funds. So they did that en mass too. That added momentum to both mutual fund under-performance and much better ETF performance in general. • It took time to "work out the bugs" in ETF management. This made their numbers comparable with mutual funds around 2013. • Gazillions of advertising went into ETF marketing, resulting in most everyone thinking ETFs were superior to mutual funds. They were not at the time, so it was all bogus, and somewhat still is. But as time marches on, ETFs are finally getting their acts together. Enough to start maintaining Model Portfolios using both. So starting May 2016, there's Hybrid Models using the fee-based mutual fund picks and ETFs. Linked returns that account for trades, rebalancings, and asset class weight changes won't start until March '17, because there won't anything to link until Febrary's returns are in. Why S&P 500 ETFs are the Tail Wagging the Stock Market Dog Now on to the white elephant in the room that nobody wants to talk about. It's the shiny new iToy that if you're not playing with, then "you're not cool, grandpa!" It's the "current fad" and the bubble that's currently being inflated by one financial adviser, and 401(k) participant, at a time. It will eventually pop, just like every bubble in the past, wiping out trillions of dollars and millions of lives. First, how and why this got started: For decades (since 1977, when Vanguard invented the S&P 500 Index fund, and John Bogel started his crusade to get investors to "just buy the whole market"), people like Bogel have been saying, "Don't hire active money managers because they can't even beat the markets. Why pay their stiff fees for this constant underperformance? Just buy and hold the whole market via index mutual funds. It took investors decades to wake up to this basic mundane reality and do just that. So that's what they've been doing en masse since 2010 or so (especially in their 401k plans). Then bonds haven't yielded anything since the last century. So there's nowhere for them to go but down. Then because of the Great Real Estate Crash that started in 2007, that safe haven had to be abandoned too. Then most everything overseas crashed even more than the US markets during the Great Meltdown, making asset allocation techniques appear feckless, so that had to be abandoned too. Then all of the quantitative easing by the Federal Reserved failed to ignite hyper-inflation, like the Chicken Little TV tards have been screaming about for a decade, so direct gold and silver investing had to be abandoned too. Then for the last decade, bazillions in Wall Street marketing ads have brainwashed investors into buying ETFs instead of regular old-school boring not-cool plodding open-ended mutual funds. Add these factors together, and that's why most everyone is now buying mostly only S&P 500 ETFs. When everyone is essentially buying only the same thing, it goes up much more than everything else. This is why it can't be beat. When the phenomena becomes so big that it overwhelms everything else, then it becomes "the tail that wags the dog." So S&P 500 ETFs have been the tail that's been wagging the whole stock market dog for several years. If you're thinking this is fine, then you are incorrect. It's only fine when the S&P 500 is going up, or remains stable. If and when it goes down enough, which it will, everyone will bail and sell their S&P 500 ETFs with a few mouse clicks, like the proverbial flock of lemmings waddling off the cliff. Now you're thinking, "I'll just sell before everyone else, and make a ton of money, and leave everyone else holding the bag with the bill of goods inside!" Sorry, incorrect again. Wall Street has better access to this information before you, is faster, smarter, and their computers will execute their massive pre-programed sell everything now trades before yours. Actually, their program trades will execute in the middle of the night when the markets are closed while you're asleep, because they can do that and you usually cannot. So YOU will be the one holding the bag with the bill of goods inside. Just like the last time, and the time before that, and the time before that. Remember? NO!? Well, there's your failure! That's exactly the kind of preventable debacle that occurs over and over and over. This causes the loss of trillions of capital, which starts the recessions and depressions that last for Decades, that literally ruins the lives and kills off and of dozens of millions of Americans. So sorry Wall Street, y'all may be sitting rich and pretty because of your ETF sales, but these chickens WILL come home to roost someday, and then again and as usual, it will be YOUR FAULT! But this time there ain't gonna be multi-gazillion dollar taxpayer-funded government bailouts. So everyone needs to wise up and smell reality and start practicing much more asset allocation diversification, or you WILL be sorry! As you were taught in kindergarten, "There ain't no free lunch." About ETF Investing in General If you're thinking about trying ETFs because mutual funds and stocks have you let down, then you are just going to be even more disappointed. They are basically the same old thing packaged up in a slightly different wrapper. So they are going to get the same old results, but probably a bit worse. There are few reasons to use ETFs, or think that they are something special. They're just mutual funds that can trade during the day, which is the big advantage because Mutual funds are only priced and only trade at the end of the trading day. As you may know, most everything in the financial world is a shade of gray, rather than black and white, so it's best to discuss advantages and disadvantages. First, the list of advantages: Eventually there will be an ETF that specializes in everything. On the other hand, there are already mutual funds that specialize in everything enough. I have yet to see an ETF for something useful where there was no regular old mutual fund doing the same thing (having the same fund objective). There may be ETFs for small trading niche markets that aren't very useful for sane rational investors, like RUSS (Direxion Daily Russia Bear 3X ETF), so for the very few that care about such things, then this is an advantage. One can quickly buy and sell in and out of them during the trading day, just like a stock. As you've read above, you shouldn't be doing that in the first place, because that's market timing. So it's not really an advantage. It's THE advantage that should not be taken advantage of. You can buy an ETF with less money than a mutual fund (sometimes). Most mutual funds have initial minimums of ~$2,500, whereas you can sometimes buy just a few ETF shares. ETFs also do not have minimum holding periods, like some mutual fund are starting to have. They also allow one to control taxable events better, as random capital gains distributions with mutual funds in taxable accounts can be annoying. Because some don't sell the underlying securities, there's less of these "phantom" capital gains taxes. US investors currently living outside the US, can sometimes buy ETFs, when they are sometimes barred from buying mutual funds. Most non-US-based investors are not allowed to buy US mutual funds (the same as where most US-based investors are barred from buying many non-US funds). Then the funds they can buy in Europe, for example, have both much higher management and trading fees. An example would be FXF (Swiss Franc Currencyshare). For Europeans living in Europe (Switzerland specifically), and retiring in Europe, if lots of money is in an IRA account that they don't want to distribute for tax reasons, one easy way to remove some currency risk (e.g. of the dollar dropping) in the IRA is to keep Swiss Franc cash in a Swiss Franc ETF. There are other ways to do these things with options, and other derivatives, but ETFs are more straightforward and easier to understand. • There are no 12b-1 fees, nor any of that controversy, with ETFs. So you don't have that ~0.25% annual headwind to slow you down. But for BD Rep advisers, this means about a 15% pay cut. • Most ETFs have lower management fees. The average net expense ratio of investor no-load share class corporate bond funds in Dec '14 was 0.46%. The same in ETFs was 0.21%. You can sell ETFs short, buy on margin, and use limit / stop-loss orders and similar trading collars and market orders. You cannot do this with open-ended mutual funds (you can do some of this with closed-end funds). This is also a futile market timing technique that should be avoided, so it�s not really an advantage to retail investors (because they'll usually get this wrong). That�s about it for the advantages, now the disadvantages: The most important thing is performance. ETFs are too easy to beat on a risk / return basis compared to regular open-ended mutual funds. For proof, see the return comparisons on the mutual fund picks page (compare the ETF returns with mutual fund pick, and index, returns). Mutual funds consistently beat the same flavor of ETFs around 90% of the time. This huge difference overwhelms any lower fees ETFs charge (because performance is stated after all fees and expenses). ETFs are not always cheaper to own, don't always provide the lowest costs, and/or the most efficient way to invest. It's true that they don't have front-end loads, back-end loads, or 12b-1 fees; and have lower management fees. Unlike a true no-load mutual fund, where if you go directly through the fund then it's totally free, you always have to pay a commission or ticket charge or some kind of transaction fee to buy or sell an ETF (the product distributors need to be fed, which is the majority of the reason why the product was born and touted in the first place). The only way to negate this effect, is to buy and hold the ETF for the duration. If you do this, then you're not using ETF's main advantage � which is the ability to trade during the day. Then more than likely, your returns will be lower with the ETF compared to a mutual fund. This amount will probably end up being many times the dollar amount of lower ETF fees and expenses. • Some ETFs have hidden fees that go to pay the initial institutional investment house that gave birth to them. You don't see them anywhere because these fees are bundled into their IPO (wholesale) prices. The people that actually do the important portfolio management work, the managers, get paid and well (so this money goes to them - the few on Wall Street that actually deserve it). Why is this different or better than a mutual fund? It's not. Most all ETF managers were mutual fund managers that bailed when offered more money to manage the ETF. The point is that ETF managers are the same as mutual fund managers - so they are not better in any way. Some managers manage both ETFs and mutual funds. Frequent ETF traders (should) know there's usually a significant gap between an ETF's asking price and its selling price. A large "bid-ask" spread can make an ETF more expensive to buy and render less money when selling, cutting into an investor's profit. The most frequently traded ETFs have the narrowest bid-ask spreads. The biggest and oldest ETF (SPY: S&P 500, which tracks the Standard & Poor's 500 index), usually has a bid-ask spread of around a penny on shares that trade for ~$125. By contrast, the spread can run around a dollar at times for ETFs that venture into narrower market segments with shares costing less than $50. So if bid-ask spreads are a concern, then go with bigger ETFs rather than niche offerings. ETFs usually trade at a premium due to their novelty. This is the same thing as a stock being artificially and temporarily bid up, just because there are more buyers than sellers at the time. Around 75% of ETFs trade at a premium. The smaller the niche, the more the premium. For example, international ETFs usually have twice the premium than domestic ETFs. For example, an ETF like BZF (Wisdom Tree Brazilian Real Strategy F) may have premiums or discounts in the 25% range. This is for no better reason than people making market timing forecasts about where that currency may be headed short-term, based on random daily news and economic statistics. Paying this can be a much higher cost than paying the highest front-end load on a mutual fund. What this means is if the value of all of the securities inside the ETF total up to being worth $100, then you may still have to pay $110 for it. This is for no better reason than there's too many people buying it at the time, artificially driving the price up. In other words, you're paying an extra $10 just because it�s currently cool. They're charging more for it, for no better reason than they can, because people will pay it. The point is that this premium can magically go away, just as quickly as it magically showed up. All it takes is for a new ETF to launch in the same asset class, and this huge premium could turn into a huge discount overnight (just because supply in that niche doubled). So you could lose a significant percentage of your money, even if the underlying value of the securities did not change. This is the same effect that made it so closed-end mutual funds didn't catch on. They can trade at significant price differences compared to the value of the underlying securities. These can be very random, which can end up quickly losing a lot of money. Open-ended mutual funds do not have this effect. The price (AKA NAV, or net asset value) is always fixed at the value of the underlying securities. They're just hard-wired to be this way, and cannot be anything different. This is why most everyone uses them, and hardly anyone uses closed-end mutual funds. We went through a lot of work trying to make Models using closed-end funds in the early 2000s. The bottom line of why that didn't work, is that it's not possible to screen them, just because of these discounts and premiums (due mostly to very thin trading by way too few investors). They were much too fast, large, and random. They basically 'flopped around all over the place' for no apparent reason. So they just didn't fit in with any normal, regular, sane, rational investment strategy. So this very small niche market is left to the very few investors that have narrow focused expertise with the underlying securities that the closed-end mutual fund holds. For example, if you've worked in the semiconductor industry all of your life, and thus are keeping a constant bead on what all of the major players are doing every day, then you can do the math on a closed-end fund that holds only stocks of these major players, to gauge whether the current discount or premium is warranted or not. If not, then this anomaly can be exploited for profit. The point here is that people, mostly financial advisers, think they have magic powers and can tell if a very large basket of stocks in an ETF is currently overpriced or underpriced relative to the value of the underlying securities it holds. They do not have these magic powers, so they cannot, and that�s the point. Just evaluate their track record, and then you will see. We have yet to find an ETF jockey that consistently beats mutual fund investing. They love to tout how cool they are because they're on top of the current fad by using ETFs, but they run away when pressed for their actual numbers. Not one ever has had the beef to back up their boasting. • ETFs are bad when rebalancing an asset allocation mix, because of the commissions when both buying and selling. As a percentage, these amounts can be very high, especially in smaller accounts. • ETFs are just as opaque as mutual funds. You have no idea what�s really going on inside because the managers keep it all a secret so it can�t be easily duplicated. So the data they report is just as old and outdated and stale and meaningless as with mutual funds. So there's no difference in transparency. ETFs are more risky. Too many ETF managers have less than a few years of experience managing money when they started managing their ETF. Too many are basically newbies that failed getting rich quick by running a hedge fund, or are just as much of a rookie as a new high school graduate getting their insurance or securities license. There are no experience requirements needed to open a new ETF. Anyone can do it just by paying a few thousand bucks and filling out a few forms. Most ETFs are undercapitalized, with some having just a few million under management. The smaller this amount, the riskier the deal. A good minimum number to use is $25M in assets (the same with funds). ETFs are lame. They talk the talk, but usually can't walk the walk. Most ETF index-like funds lag the same kind of index mutual fund or benchmark. So it's both cheaper and safer to just buy a no-load index fund. ETFs are also more volatile than their best-fitting index mutual fund, but have similar covariances. So index mutual funds move more like the benchmark indices. This is what you want when you index invest. ETFs also don't track as well as mutual funds by a few basis points. This is also what you want when you index invest. Sometimes, market orders (e.g., stop loss limits) are just ignored with ETFs, if it�s not highly liquid. ETFs also have a harder time reacting quickly enough to changes in the underlying benchmark. ETFs hold more cash, compared to mutual funds. Using December '14 data, the average of all ETFs held 16.6% in cash, whereas no-load funds held 11.1%. You're paying managers to invest your money, not keep it under the mattress, so the lower the cash number, the better. ETFs are also new, most barely have a five-year track record, and so far their performance has been average. Over time, people will start writing about how they didn't pan out as expected. Sometimes, you're limited to buying ETFs in 100-share lots. There's nothing good about this restriction. • If the underlying institution that gave birth to the ETF goes under, then you'll have problems. Most thought this could never happen, until the Great Meltdown. Investors won't know beforehand which large companies are likely to disappear (e.g., Lehman Brothers), thereby forcing an unplanned liquidation of the funds at fire sale prices. If the parent company of a closed-end fund goes under, the fund would just sell everything on the open markets, wrap up, and pay the shareholders the proceeds. You may never see a penny if an ETF goes under, whereas you�d get the vast majority of your money back if a mutual fund closes. End of the list of disadvantages. Here's the differences between ETF and closed-end funds (CEFs): Closed-end funds are also supposed to be called closed-end companies according to the SEC. They're called Investment Trusts in Europe and Listed Investment Companies in Australia. They close everything once the investments are bought and the number of shares to be sold has been determined. Next, buyer beware! Because ETFs and closed-end funds are pretty much the same things, there have been many scammers out selling closed-end funds as ETFs to cash in on the fad. They do this to collect the higher commissions. Just check the trading ticker symbol - ETFs do not end in X. Now the list of differences: Closed-end funds issue a finite number of shares. ETFs can issue more shares if they want to. • Because of their internal structure, ETF shares can be created and retired on an active basis by the market maker that gave birth to them, or other large institutions on an ad hoc basis. This makes the market price of an ETF trade in a more narrow range that's closer to its net asset value (~15%) than CEFs. This is because they allow institutional traders to redeem shares for a "basket" of the fund's underlying assets (you, nor your advisor, can't do any of this, so it's not a unique advantage to the retail investor). • Some ETFs offer "in-kind redemptions," which can keep the capital gains taxes down, but this also is usually limited to institutional investors, so it's not really an advantage to the retail investor. With ETFs, dividends are reinvested on the day of receipt and paid to shareholders in cash every quarter. Whereas with closed-end funds, they're all accumulated and distributed when the funds feels like it. The ETF investor owns the underlying shares in the companies that the ETF is invested in, including the voting rights associated with being a shareholder. If you think this is an advantage, then ask yourself when was the last time you, or your adviser, or your adviser's parent firm, voted or even attended any shareholder meeting? Rarely to never, so this is not an advantage. Some ETFs are more passive, and some are more actively managed, compared to closed-end funds. You'd have to do your homework to tell the difference. Not all ETFs are more passively managed than closed-end funds. • Some ETFs have hidden fees that go to pay the initial institutional investment house that gave birth to them. You don't see them anywhere because these fees are bundled into their IPO (wholesale) prices. • If the underlying institution that gave birth to the ETF goes under, then you'll have problems. Most thought this could never happen, until the Great Meltdown. Investors won't know beforehand which large companies are likely to disappear (e.g., Lehman Brothers), thereby forcing an unplanned liquidation of the funds at fire sale prices. If the parent company of a closed-end fund goes under, the fund would just sell everything on the open markets, wrap up, and pay the shareholders the proceeds. You may never see a penny if an ETF goes under, whereas you�d get the vast majority of your money back if a mutual fund closes. • Leveraged inverse ETFs that double or triple an index in the opposite direction - a month of volatile markets could magnify tracking error because of the exaggerated daily price moves. During the meltdown, both leveraged, and inverse leveraged ETFs had losses on the same underlying security. Some natural gas ETFs from US Commodity Funds, LLC were down 17% from a year earlier at the end of March '09, while at the same time natural gas prices were up 7.4%. During May's "Flash Crash" over 70% of the securities that fell by more than 60% were ETFs. Market orders (e.g., stop losses) then kicked in, causing a self-fulfilling prophecy that was the Flash Crash (caused by a Waddell & Reed manager). If you were thinking there would be a longer list of differences between ETFs and closed-end mutual funds, then you are mistaken. ETFs are just the same old thing (a basket of the same underlying stocks) just packaged up in a different closed-fashion of marketing wrapper. So as you can see, there's not much difference between ETFs and closed-end funds, so it's amazing to see little-to-no interest in closed-end funds for decades, and then when ETFs came out, everyone and their uncle just has to use them for everything. End of comparing ETFs with closed-end mutual funds. Back to generic whining about ETFs: This phenomena of ETFs being the tail wagging the market dog, wasn�t there before the Great Meltdown. Other asset classes outperformed the S&P 500 before five years ago. It's only showing up in the five-year returns and less. So before this all started, it was normal for 13 of these 18 asset classes to beat the markets. In 2012, it was down to four. In 2011, it was only one. Since '09, the S&P 500 has beaten all 18 asset classes about a third of the time. In 2014, the S&P 500 outperformed all 22 asset classes, except tech, biotech, real estate, and international small-cap. The S&P 500 has even done much better than the DJIA 30 since about four years ago. That's because this all started shortly after the crash of March '09. Out of the 5,000+ stocks available, at least investors know better than to herd into 500 stocks, instead of just 30, so that helps. Since nobody can predict anything even close to this level of accuracy, then nobody's diversified investment portfolio has beaten the S&P 500 over these time frames. You didn't, your advisor did not, and your stock picker and/or market timer definitely did not. Nobody can beat the one and only thing where the sheeple are putting ALL of their money all at the same time. It just can't happen, not mathematically possible, unless one lucks out with a risky market timing call. So unless you want to continue taking on massive amounts of risk by having all of your eggs in one big equity-filled basket (S&P 500), then you should wise up and stop doing that ASAP. Because when the S&P 500 stops being the one and only thing in the world investors buy, you're going to lose a lot of money before you even know it, then you could not recover for another decade (again). The only other way to beat the markets is to know for sure in advance that it's going up or down, then load up on leveraged S&P 500 ETFs, options, or futures. That may work here and there, but more than a year or two, and those risks will wipe out any alpha gained. This strategy is just pure market timing, and all of that was proved to not work at all way back in the 20th century. Before the Great Meltdown, things were different. Most equity asset classes did better than the S&P 500 when it was going up, and lost a lot less when it went down. This is because investors were buying individual stocks and bonds, which outperformed the S&P 500. Also, bonds not yielding anything anymore just adds fuel to this fire. Now ETFs are the tail wagging the stock market dog. Whenever this has happened in the past, the bubble eventually pops, and then millions of sheeple lose trillions of dollars of their wealth before they can do anything about it. Then they have no idea why, they panic, sell out, lay blame on everyone but themselves, claim the system is too rigged against them, and then they don't invest in America for many years, if not decades. So all of this won't be changing until the "market-index-based ETF bubble" finally pops, and it's front-page news. What to do about all of this if you're a people and not a sheeple: Don't buy S&P 500 or DJIA 30 based ETFs because of these risks and problems. If you want to buy a market-based index, then buy and hold Vanguard Total Stock Market Index Investors (VGTSX). Why? Because it has the same 500 and/or 30 stocks, plus thousands more. So it's a much more diversified investment dog that won't get put down when the ETF tail wags it into crashing. Then remember not to buy the total stock market ETF, because ETFs' only advantage is that you can trade during the day. If you're a normal sane rational long-term investor, then you do not even remotely know enough to be able to profit by short-term trading with it, so there are zero advantages. So just buy the boring old index mutual fund and hold it and ignore it and take your chances. The flowing image paste from Morningstar proves the point: Vanguard's (S&P) 500 Index Admiral Mutual Fund (VFIAX) outperformed the same S&P 500 ETF since its inception (even Vanguard's ETF). Yes, this is AFTER all fees and expenses: You can download this image from here if you want to see it better. Regular open-ended mutual funds beat the same ETFs over 90% of the time. Then this is when the markets have been on a long-term upswing. If they were down, or crashing, during this time frame, then the mutual fund would probably have outperformed the ETF by a huge margin (instead of just barely - which was driven mostly by minor differences in fees and expenses). This is the bottom line you should care about - if you're a normal, sane, rational investor. Then on top of that, if the adviser is using their only advantage (the ability to be bought or sold during the trading day), then their usage of market timing will most always result in much lower long-term performance. The younger, more green and rookie they are, the more their naive market timing calls will be wrong. The more they're wrong, the more money you're going to lose in less time. So there is no way around this. You are almost guaranteed to realize lower returns with higher risks when you use ETFs. This is because their risks are higher and their returns are lower than mutual funds, and then advisers that have yet to get a clue, are bailing when the markets hiccup during the day, thinking this brilliant method of market timing is adding value - when it does not most of the time. So since there is no other advantage in using them, then it is just not possible for them to outperform regular old boring buy and hold asset allocation techniques using mutual funds. The bottom line here is that advisers that use and defend ETFs just "don't know what they're doing," and thus should be avoided. So when you hear their pitch on how they want to manage your money, as soon as the word ETF is said, just say no. Or if you're still curious, then ask for their track record. Then you'll see that they either don't have one (big surprise, because even if they do maintain it, it would be too embarrassingly bad to show you), or it will be bad. Just don't hire money managers with a bad history of managing money in the Real World. This has to be true, because it's an inferior investment management strategy. There is no way possible for it to beat mutual funds, unless they're currently on a lucky market timing streak. The way to tell, is to just check their returns next month. Then you'll see. Market timing lucky streaks rarely last more than a year. Another bottom line is this: Young adviser (under 40) + ETFs = Bad risky investment performance. I have yet to see this NOT prove true. It's rare for it not to be true. If someone is having a current lucky streak, then just check back later, and then you'll see that this situation has reversed itself dramatically (AKA reverting to the mean). That's all you need to know about this current fad and elephant in the room that everyone is too afraid to talk about. So unless you're a trader, then just say no to ETFs. If ETFs were "better" in any way, then the returns would be beating mutual funds, and then we'd be a big fan too (and making a fuss about how Wall Street did something right for a change). But they are not. It's all just more BS in an industry that is mostly all BS. It's just as simple and easy to understand as that. ETFs are best for traders (people that get in and out of positions short-term, AKA day trading, because they think their brilliant market timing strategies add value). For normal sane rational individual investors investing wisely for critical long-term goals (college funding and retirement), there are more advantages than disadvantages in using regular mutual funds. Over time, interest in ETFs will probably fade just like index mutual funds and closed-end funds did. The only real advantage is ETFs being the vehicle that's currently able to replace "THE Big Problem" with financial advisers of the last century, which was "stock jockeys." In the 21st century, in order for financial advisers to think their brilliant money management strategies and tactics have more value than their competition, and therefore the only way they're going to realize their big dream of "getting rich quick on Wall Street," is to market time with ETFs. So they think they need to be "ETF jockeys," or nobody will hire them. This is why they all seem to be doing the same thing. Then the younger and more rookie they are, the more they're going to want and need to take the big risks riding those ETFs. So advisors have to get with the ETF program or be left out. Some advisers use them only because their clients want them to, and then most clients only want them to only because they're sick of them losing tons of money by chasing hot stocks and market timing (so it's the lesser of the two evils). To be fair, ETF jockeying is better than stock jockeying, because the more stocks you're trying to ride, the more diversification you'll have. The more diversification, the less risks. Which is the point, which is why you should just go all the way with that, by using asset allocation, and not market timing with ETFs. This fad can only go on for so long, and then it will peter out. Once everybody knows about them, the reality of sub-par returns will set in. Or the fad will end when the S&P 500 ETF bubble pops. In the financial services industry, one should know there are serious fundamental problems with something new when EVERYONE agrees that it's the coolest thing since the invention of the wheel. At the moment, everyone thinks ETFs are the wave of the future and will magically solve all of the annoying problems, dilemmas, inefficiencies, and conundrums with investing. The same was said with closed-end funds in the 80's and then index funds in the 90's. They were supposed to take over the investing world with their low risk and rock bottom fees and expenses. What happened? Once the hyping dust settled, ad money dwindled, risk vs. return reality sets in, then they ended up being put in their proper place. ETFs will end up in the exact same place eventually. History is just repeating itself with a new version of a similar concept. This happens because people are ignorant and forget what happened when these initial concepts were marketed before. Also because rookies are clueless about what happened in the past, they see it as a new method to market their services in a way that makes them different, and thus superior over their competition. So they'll willing to roll the dice with their future much more than usual via ETFs. Since everyone is on the ETF fad bandwagon. It's just easier for a rookie advisor to get a new prospect to turn into a client by hitting them with something the financial press has been beating into their heads for years - how great this new thing called the ETF is and how it will make you rich quick by lowering risk while saving you big money on fees and commissions. Once a product survives the test of time and is now seasoned, half of veteran financial professionals will love it, and the other half will hate it. Usually only the ones profiting somehow end up loving it. Over time, the ones that hate something have had their reasons posted in cyberspace and have had dozens of rounds of rebuttals from the ones that love it, and vice versa. We're still in the honeymoon phase, and are over a decade away from that with ETFs. But don't worry, the cold hard facts of reality will set in over the years, and this fad will slowly fade into its proper place, just like index funds. Similar investment vehicles (e.g., variable annuities, limited partnerships, whole life insurance, hedge funds, American Funds, etc.) that took an eternity for the enlightened financial world to conclude that they're "bad," are all great examples of how history will eventually judge ETFs. ETFs are riding as high as they ever will at the moment. So the only direction for them to go is down from here. In 1999 Vanguard index funds founder, John C. Bogle said, "ETFs are like a shotgun, great for hunting but also great for suicide." Morningstar"s Don Phillips, "...but on the ETF side, there's still this arms-dealer mentality. ...we just make the weapons and what people do with them is their responsibility, not ours." There was (hopefully) a once in a lifetime financial meltdown from '07 to '09 that pretty much wiped out most everything financial - especially investors and professional advisors that liked investing using stock picking and market timing strategies and tactics. Immediately after that, investors en masse pretty much gave up on trading stocks via "advice and hot tips" from tards like Jim Cramer, after they got wiped out. They had little-to-no diversification, so when their stocks went down 50% to 75%, what did they do? They panicked and sold out at the bottom, of course, like they have always done since there were tulip bulbs, stock markets and/or anything to speculate on getting rich quick with. So if the S&P 500 was down 25%, they were down over 50%. If they held financial stocks, like Lehman, Bear, or any of the banks that went under; then they lost 90% to 100%. Then they said, "The stock market is rigged, I'll never invest in stocks ever again, I'm out for good this time, baaaaa!" This led to stock markets averaging almost less than T-bills from 2001 until 2013. They pretty much got wiped out because of all of that, so since '09 they are favoring baskets of stocks that trade easily - pretty much only using S&P 500 or DJIA 30-based ETFs. So when the mass herds of both investors and professional advisors in sheeple mode are only buying essentially one thing, and that one thing is your benchmark, then the one and only way to beat it is to own more than they do, with leverage. A way to tell is to compare the S&P 500 return to the Moderate Benchmark Index Model�s returns. When the S&P 500 beats that, then it's because investors are "only buying S&P 500 ETFs" - and then only when they think the markets will be going up. So this is just the way it's going to be until they wake up and realize that buying that only when it's going up and selling it only when it's going down doesn't work either. So they're still applying the last century's failed investing model of "buying stocks at the top via irrational exuberance, and then selling them at the bottom via fear and panic." Now market-based ETFs are the tail that wag the market dog, so nobody is "beating the markets anymore" Making the switch from stocks to a pooled investment vehicle with diversification was and is a good thing, but since the marketing is so strong, they're mostly just getting out of Mutual funds and into ETFs by the herds. This bad move is just putting more hot air into this "market-index-based ETF bubble." It took professional advisors managing money for individual investors much more time after the meltdown to realize that their old 20th century investment strategies stopped working too, but they eventually capitulated and stopped using security selection techniques to pick stocks. Then they just had to switch from mutual funds to ETFs as to not be left off the party bandwagon. If their clients are constantly asking about ETFs via the bazillions in Wall Street ads, then why fight it? Just go with the flow and give them what they want, and life is much easier. What could go wrong with something everyone else is doing that seems to be working just fine for years now? Then if it does blow up, they can say, "The exact same thing happened to everyone else, so don't fire me. If you do, then who will you hire to replace me? You would have had the same results, and maybe worse, across the street." This has led to a new chapter in investing in the U.S. This one won't end well either. The old saying that rings most true here is this, "Just because something is shiny and new and you can, does not mean that you have to, or that you should." ETFs are just not near as cool as all of that when it comes to anything at all - unless you're a trader. ETFs are only for traders, not sane rational long-term investors. If ETFs were better where it actually counted; performance, then our ETF Models would be constantly creaming everything else (because the asset class weights are the same). But they've been at the bottom of the pack since inception, are there now, and always will be. Why? Very simple, mutual funds are better. All of this is just round dozen of the exact same thing that has caused the repeated mass wiping out of investors' wealth since the late 1800's (AKA financial bubbles popping). It's all the exact same short-sighted fear vs. greed stupidity as tulip bulbs were long ago. It's the same play, just different actors. Investors will probably eventually learn, so give it a decade, as they're a bit slow when it comes to understanding all of this. Advisers usually don't learn until clients start pulling accounts and either start doing it themselves, or hiring a better adviser using techniques with more asset class diversification. So this is just the way it's going to be until everyone wakes up and realizes that buying S&P 500 ETFs only when they're going up, and then selling only when they're going down, doesn't work either. It might seem like it's working fine now, but all of this is relatively new, so just wait. The only Wall Street invention that's been touted this heavily that actually worked out in the long run, has been regular old boring open-ended mutual funds. Applying the last century's failed investing model of "buying high and selling low" never worked. But now "everyone" is just out doing that with ETFs instead of stocks and bonds. When you "do the actual math," then the bottom line on ETFs is already clear as a bell: ETFs are only for short-term traders that think they can profit very short-term via their market timing calls. So if you're not a short-term trader, just use mutual funds of several more asset classes than just the DJIA 30 or S&P 500, and you'll do much better long-term. Here's a Word docx that has financial articles about all of this |

Financial Planning Software Modules For Sale (are listed below) Financial Planning Software that's Fully-Integrated Goals-Only "Financial Planning Software" Retirement Planning Software Menu: Something for Everyone Comprehensive Asset Allocation Software Model Portfolio Allocations with Historical Returns Monthly-updated ETF and Mutual Fund Picks DIY Investment Portfolio Benchmarking Program Financial Planning Fact Finders for Financial Planners Gathering Data from Clients Investment Policy Statement Software (IPS) Life Insurance Calculator (AKA Capital Needs Analysis Software) Bond Calculators for Duration, Convexity, YTM, Accretion, and Amortization Investment Software for Comparing the 27 Most Popular Methods of Investing Rental Real Estate Investing Software Net Worth Calculator (Balance Sheet Maker) and 75-year Net Worth Projector Financial Seminar Covering Retirement Planning and Investment Management Sales Tools for Financial Adviser Marketing Personal Budget Software and 75-year Cash Flow Projector TVM Financial Tools and Financial Calculators Our Unique Financial Services Buy or Sell a Financial Planning Practice Miscellaneous Pages of Interest Primer Tutorial to Learn the Basics of Financial Planning Software About the Department of Labor's New Fiduciary Rules Using Asset Allocation to Manage Money Download Brokerage Data into Spreadsheets How to Integrate Financial Planning Software Modules to Share Data CRM and Portfolio Management Software About Efficient Frontier Portfolio Optimizers Calculating Your Investment Risk Tolerance |

© Copyright 1997 - 2018 Tools For Money, All Rights Reserved