About 401(k) Plan Self-Management |

| Site Information (is listed below. The financial planning software modules for sale are on the right-side column) Confused? It Makes More Sense if You Start at the Home Page How to Buy Investment Software Financial Planning Software Support Financial Planner Software Updates Site Information, Ordering Security, Privacy, FAQs Questions about Personal Finance Software? Call (707) 996-9664 or Send E-mail to support@toolsformoney.com Free Downloads and Money Tools Free Sample Comprehensive Financial Plans Free Money Software Downloads, Tutorials, Primers, Freebies, Investing Tips, and Other Resources List of Free Financial Planning Software Demos Selected Links to Other Relevant Money Websites

|

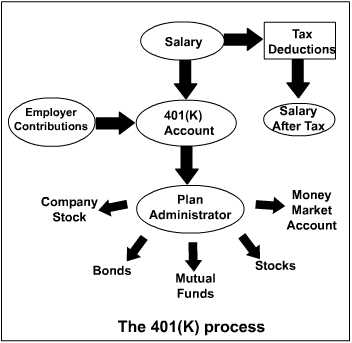

First, Generic 401(k) Information 401(k)s were authorized by the creation of tax-deferred savings plans for W-2 employees when Congress passed the Tax Reform Act of 1978. Then it was formalized with Internal Revenue Code - Section 401, paragraph (k). Similar tax-qualified retirement plans for teachers, employees of churches, public hospitals, and nonprofit organizations are called 403(b) plans. Retirement plans for state or local government employees are called 457 plans. All of these employer-based plans are just called "401(k) plans" on this page. Other than minor differences in rules, they're all pretty much the same. 401(k)s are classified as defined contribution plans, like profit sharing plans, IRAs and Simple IRAs, SEPs, money purchase plans, and other hybrid plans. This is because only the contributions are "defined." This is very different from defined benefit plans, where the amount of monthly benefit at retirement is what's being defined (e.g., you'll get a pension check of $500 a month at age 65 for life). These are known as "pension plans," and are rare because of the high costs involved (to the company). Free Investing Advice on How to Get the Most Out of Your 401(k) Plan This page has helpful information to understand what's going on, and what you can do to get the most from your money - while in captivity and afterwards. It's also about optimizing investment performance while being captive to a retirement plan. Being captive means you're stuck with your plan, and can't do anything about most of it. So your only choice is to play or not to play. How a 401(k) plan is managed while the investor (AKA the participant) is captive to it is critical. Even though it could mean the difference between steak and Alpo after a decade of retirement, 401(k)s are still the most neglected part of retirement planning. Even after reading this page, very few will do anything about their most serious ongoing 401(k) problems (ditto with their financial advisors). So these problems are left to fester for decades, and the result is usually having less than half of the retirement paycheck than the plan could have provided with just a little common sense attention paid to it. Even if you hire a financial advisor to manage other investments, 401(k) plan management is usually overlooked. Investment managers just don't like to spend resources giving advice on them. This is because it's a lot of work, it's too hard to get the data needed, things change too much, they're not up to speed on your plan, they probably don't have the software tools needed to do the work, they don't know what to do, and then they're rarely paid for it. This is because they can't use their firm's custodian to hold and control the assets; which means they can't make commissions on trading, nor can they get paid directly by charging fees as a percentage of assets. The only time they're paid is when the investor writes a separate check that directly compensates the money manager for 401k management. So advisors usually just take the path of least resistance, which is to ignore them - even when it's the client's largest asset, and is being badly neglected or mismanaged. The investment strategies used to manage 401(k)s are the same as those described on the Model Portfolios page. The only difference is they're funded with just the 401k plan's limited (captive) investment choices. Once you can escape its captivity, then you're free from all of these problems, expenses, and limitations. Then you can do dozens of good things, like self-managing your money using a turnkey approach like our Model Portfolios via a Discount Broker. Once you roll your 401k away from captivity and to an online discount broker, there's an unlimited supply of investment strategies and tactics you can use. The broker will usually even give you free asset allocation software. You can do whatever you want when you do it yourself. If you try something and don't like it, then you're free to just stop using it and try something else. Why Good Do-it-yourself Investment Management is Needed: The Pitfalls of 401(k) Plans and How to Avoid Common Blunders The biggest problem with captive retirement plans is insufficient investment choices, which also means lack of asset class choices. Asset classes are how investments are categorized between the different sectors and sizes of stocks, different issuers of bonds, real estate, tangibles, and the various flavors of international investments. For example, CDs, bonds, stocks, gold, and real estate are all very different from each other in terms of risk, reward, taxation, and income generation. You can evaluate the 22 asset classes we work with on the table of historical returns on this page. This limited selection leads to lack of diversification, which results in higher risk, much higher volatility, poor investment performance, low yields, selling shares when they're down, lower spendable retirement paychecks, capital depletion, and a disappointing retirement. Participants are usually not knowledgeable about asset allocation techniques, which guide how to divvy money up between the investment options (and asset classes). This results in having too much exposure to only one type of equity market, usually large-cap value and growth stocks (via S&P 500 ETFs). This will result in losing a lot of money when the stock market goes down. Then it could never recover in your lifetime. The next problem with 401(k) plans is poor performance of the investment choices. This is true both from a naive point of view (not seeing much growth even when the markets are going up, and losing more money than the markets when they go down), and from a technical point of view (when investment vehicles underperform compared to their proper benchmark indices). Poor performance of the investment choices can stem from people that built the plan just not knowing enough to do it right, which is par for the course. But usually, this is because the packagers and marketers of the plan make the most money via their "line-up" of investment choices. So if you're wondering who picks these "dog-meat funds," why, and why don't they pick better-performing options - the answer about 75% of the time is because that's how everyone in the "system" makes the most money. About 25% of the time, it's just generic incompetence at all levels of plan creation. It's just another failure in the system. Participants usually lack the expertise needed to determine if a fund option is performing well or not. Even if they do have the expertise, they'd still need the expensive investment database software needed to perform the analysis. This is why even experienced investors hold poorly-performing options for decades. They just don't know how bad things really are, because they don't how to make the comparisons needed to tell. Then they don't want to spend over $1,000 a year for the only investment software needed to do the analysis. The combination of these two problems (lack of asset classes and then poorly-performing options) result in not fully-participating during bull markets, and losses seldom being recovered when markets eventually go back up. Then if there are trading costs involved in moving money around between the options within a plan, some participants will avoid these costs, even when they're losing many times as much by doing nothing by keeping the under-performing fund options for decades. Some 401k plans have high annual fees that employers pass on to employees. Up until 2013, most all of their fees were hidden, secret, and were not even disclosed to employers. Some plans have fees as high as 5% annually (which means your whole account needs to grow by more than 5% to not lose money). Some plans have restrictions on when money can be moved around among the investment options (e.g., only on the first trading day of the quarter). Then when a trade is made, it could take over a week for the money to actually be moved. This also helps to permanently lock in long-term losses. The combination of these problems leads to having much less money in your 401k when you retire, which leads to having much less money to spend during retirement. There's math in the Money eBook that shows how getting just 2% less over a long period of time could easily cut your retirement paycheck in half. Another important tip on managing your 401(k) is to avoid all flavors of Target Funds (AKA Life Cycle Funds). This is just one of the latest Wall Street sales gimmicks used for gathering retirement assets in the 21st century. If an investment option has a year in its name, has a certain goal in a future time period, or the word "target, cycle, or life" in its name, then it's a target fund. If it looks like a duck, walks like a duck, and quacks like a duck, then it's a duck. The short version is that target funds automatically invest in fewer stocks and more bonds as the target year approaches. This sounds logical, but the bottom-line is that they rarely perform well at the nuts and bolts level. The reason they may look like they perform okay, is because in order to analyze them properly, a very complex benchmarking process has to be used over several time frames. Only experienced analysts with the right money tools can do that work to get to the bottom lines. So if it looks like a target date fund is doing well, it's usually because it was not evaluated properly, because the vast majority do not. Every one we've looked at so far has had miserable results. Not even one has ever done okay when properly analyzed. They talk the talk, but can't walk the walk. If they could, then there would no reason to whine. Also, since target date funds are relatively new, few have reached their target year yet. So "the jury is still out." But when they come back, it will be clear that these Wall Street innovations didn't pan out well for anyone but Wall Street. Investing in target funds will probably shave 10% to 20% off of your retirement income over your lifetime. So just say no to all forms of target funds, and you'll have avoided a huge life pitfall. Here's more about target fund investing and why these types of mutual funds should never be held. The only things worse you can invest in after target date funds, are fixed annuities (or variable annuities). You should never ever do that, especially when you've just retired and someone wants you to roll your money into an annuity. Download articles about 401(k) investing Escaping 401(k) Plan Captivity Once you terminate employment, you can very easily escape 401(k) captivity. Once you stop working for that employer, or are in a position where you cannot contribute to it anymore, then you are usually immediately free to escape by transferring your 401(k) into a self-directed rollover IRA with a discount broker. This solves all of these problems in one step, just by filling out a few forms and waiting a week or so. You'll then have access to a large universe of much better-performing investment vehicles, with plenty of asset classes to choose from. Then all of the 401(k)'s fees, expenses, charges, rules, regulations, updates, restrictions, limitations, shenanigans, and wanting to sell you life insurance company products (whole life insurance and annuities) will vanish forever. After the rollover, you'll usually also have access to the discount broker's online financial tools which may allow you to determine which investments are better than others, perform basic asset allocation strategies, calculate your investment performance, etc. Last but not least, you can go online and see all of the details of your account and move money between investments whenever you want to, from anywhere, for a minimal fee, and these trades are usually executed the same day. Being able to "self-direct" your IRA results in having total control over your investment portfolio. If you self-direct adequately, then you'll be much better off. With all of these money tools, you can reconstruct your 401k into a portfolio that provides an inflation-adjusted stream of retirement income. This is its raison d'�tre, and is the most important aspect of the whole deal. But you probably won't even be able to make it perform that basic function at all if you remain captive. This is because many 401(k)s only provide life insurance company methods of realizing retirement income. These are usually called things like "life income," "life options," "life certain," "joint and survivorship," annuities or annuitizing. These are all just ways of getting you to let down your guard enough to sign over all of your money to a life insurance company. They will then buy an annuity, which is the investment vehicle that pays you the retirement income. Taking any form of an annuity payout is just handing a quarter to a third of your money and income over to the insurance company, and getting little-to-nothing in return. Then once you annuitize to get the "guaranteed safe" income stream, you're also stuck for life and have little-to-no control over anything anymore. So never do that no matter how much pressure a life insurance agent is putting on you! Just tell them no, you're taking a lump sum and rolling it over to a self-directed discount brokerage IRA. Then tell them thanks for the offer to help, but their services are no longer required (AKA, you're fired!). Always take options like lump sum, transfer, or IRA rollover. If you're retiring and you want to receive reasonable income to spend from your 401(k) plan, then it's always best to keep telling them, "I want to transfer it into a rollover IRA." Selling you an annuity is what pays by far the most commissions to the salesperson / 401(k) provider / life insurance company. These huge commissions and enormous annual fees come right out of your retirement paycheck, and provide little-to-no value to you. What you're doing is taking a lot of money away from them (all of the sales people involved with your 401k plan), that they just assumed they would have when you retired. They've been banking on this event for years, if not decades. So they're going to pretend you can't do that, or they don't understand, or you don't know what you're talking about, or they're the financial experts and you're just an idiot, or try to trick you into some form of annuitizing. Never sign any of their forms! Once you've signed up for an annuity, you're stuck with that contract for life with no way to escape. Don't sign anything if it even remotely looks like it's from a life insurance company. Here's how to avoid this cleverly laid trap: First pick a discount broker / custodian you like, and get their IRA rollover transfer forms. Have them all filled out, and then contact your 401(k) about rolling everything over to a self-directed IRA. Better yet, do not even ask for nor fill out any of your 401k forms, and just let your new custodian do all of the paperwork for you, as some will. That's right; some of the better discount brokers will do ALL of this paperwork for you - for free! Just let them, ignore all of the whiny communications from your 401k plan's marketing department, set the new IRA up, sell all of the bad investments and buy good ones, and then just get on with your life and don't look back (because all of these old obstacles are now gone forever, and all of the new obstacles are now in front of you). The people at your old 401(k) will be unhappy with you, but you'll never have to deal with them again after the transfer. So their unhappiness that you didn't fall for their planned life insurance company product traps doesn't matter. You also may be able to rollover your 401k while still being captive if your plan allows what's called, "in service distributions." If it does, then you can at least do a partial rollover / transfer for the maximum amount. It's worth looking into, because if you can, then you should. Once you've escaped 401k captivity, and opened up a discount brokerage account, then you can learn how to manage your own investments. The beef on how to do all of this at the nuts and bolts level is in our Money eBook. The bottom line is that no 401(k) plan is "good" compared to DIY (doing it yourself) via a discount broker. Even the best 401(k) plan ever created is pathetic compared to doing it all yourself. So you want to escape as soon as you can. After you're allowed to escape, then there are zero reasons to stay in your cage, and every reason to want to be set free. Everyone that wants you to remain a captive is doing so only because your money is feeding them in one way or another. There's not one thing in this feeding frenzy that provides any benefit to you. So it's always best to just fire them all ASAP, and get on with your life. Why 401(k) Plans Are in the Shape They're In Company human resource benefit managers in charge of setting up and managing these plans for employees are all referred to here as "HR people." HR people are constantly hounded by the slickest salespeople from most all of the major Wall Street players wanting to show them the wonderful benefits of their new 401(k) plans. For example, Fidelity will pound away at them with the benefit of low investment management fees. Others will use performance, low administration costs, better service and participant communications, newfangled bells and whistles (AKA annuity riders, ETFs, or target date funds), a larger list of investment choices, free retirement calculators, free investment trading, or whatever they perceive their strengths to be. So some HR people choose plans based solely on these sales pitches. But most HR people are not educated in investment management, so they don't know much more than what these salespeople tell them. Some think that having only five investment choices is just fine. So HR people may not even know how bad their plan is (just like the too-young and good-looking flunky in the nice suit that's peddling plans to them). It may take being enlightened by a concerned participant or two to wake them up to reality. Sometimes HR people are very much up on the subject, and may recommend good plans. But the company's finance people that just want to get the plan that costs the company the least money may shoot it down. So retirement plans are usually chosen by the bottom-line cost to the company, over what's best for participants. HR people also live in a world of fear. If they give their participants investment advice about which fund options to invest in over others, and it doesn't work out, they can be sued for either pretending to be a fiduciary when they're not, or being a fiduciary and then giving bad investment advice. So they just don't do that. This is why they seem to be useless when participants ask for help. It's not their fault; it's just another system failure to make this not part of their job description. It's 100% your job to take responsibility for your own financial future. All you can do is become informed, make an actual decision, and then take action. Be a driver, not a spectator. If you don't drive yourself to where you want to go, then others will be more than happy to drive you to where they want you to go - which is you somehow giving them your money for little-to-no benefit in return. Next, HR people are so overwhelmed with daily HR work, that they have no interest in selecting a better 401(k) provider. Switching plans is a very expensive and time-consuming paperwork and legal nightmare. So forget it, they're not going to change 401(k) plans because a few enlightened participants are complaining. If half of the participants constantly rode them, then maybe they'd listen, but this rarely happens. So the chances of getting them to upgrade a bad 401(k) plan are not good. Start a petition and see what happens. Some 401(k) plans are so pathetic that they should not be legal. If yours is one of them, then the amount of money you'll have at retirement could be anywhere from one half, to one quarter as much, compared to what you could have received in a well-managed self-directed IRA. Given all of this, you must realize that the plan you currently have is the plan you're going to be stuck with as long as you are captive. There is no escape. You must take control of the situation yourself to realize decent investment performance, and then have adequate retirement income. The bottom line: It's the performance of the actual investment choices inside the retirement plan, how much one holds of each, the level at which the fees and expenses eat away at your profits, and how well and how often you rebalance, that will eventually determine how much your retirement paycheck will be. That's it, there is no more, that's all there is to it - there are no other significant factors in this equation. So if you're a participant, or a financial consultant that advises participants on how to manage their 401(k)s, then all you can do is manage what you're stuck with the best you can. You can "muddle through" and that's it. For most "normal people," there's no way to tell which options to choose other than asking a friend, guessing, or reading press articles - each providing the same value. So your choice is to spend many hours researching it, hire a professional, or just resign to having a retirement paycheck that's much smaller than it should or could be. This is hard work, so it's why most participants' don't even attempt to muddle through at all. They usually just give up at the first obstacle. A 401k plan is just a tax wrapper covering a lame investment management platform. The purpose of the traditional 401(k) tax wrapper is to entice you to contribute to it, with both saving taxes on contributions, and then not having to pay dividend and capital gains taxes annually. Roth 401(k)s are a different story when it comes to taxes, but it's the same deal for everything else. But little-to-nothing is free in life, so the IRS gets all of this money back in one way or another when you retire. So when you start withdrawing money for your retirement paycheck, 100% of it is taxable at your highest ordinary marginal income tax bracket. So there is no free lunch here either, just the opposite. This is why they're called "tax-deferred accounts." You are not saving, evading, or avoiding paying any taxes - you're just putting off having to pay them until later. You can't even avoid these taxes by refusing to withdraw money, because once you reach the age of 71, the IRS requires you to withdraw money so it can be taxed (or they'll tack on stiff penalties if they have to make forced withdrawals for you). So the only way to not pay back the taxes you saved along the way is to die. Then whomever is the beneficiary of your 401(k) will be stuck paying these taxes - also at their highest marginal ordinary income tax rates on 100% of the forced income stream for life. So in a way, 401k captivity doesn't even end when you roll it over into an IRA, or even when you die. Once you're captured, then you're subject to the system's whims for life, with no way to escape (just like buying an annuity). The Step-by-step Process of 401(k) Investment Self-management The step-by-step details of how to optimize and self-direct your 401(k) plan while still being captive (even without the needed expensive investment database software) is in our Money eBook. When you have it, you'll also get five examples of how to allocate 401(k) plan money between the five risk tolerance categories. You can also get all of this when you buy the Model Portfolios. How to Tell if Your 401(k) is Not Doing Well The math below assumes that your 401(k) statement or calculator doesn't do all of this automatically for you. This is just a crude manual method of calculating returns (that doesn't account for the cash flow distortions of contributions). In the example below, all you're doing is calculating the rate of return you've received over the last three years, and then comparing it to the markets. First, determine how much you have in stocks and bonds in percentages. Most everything you invest in is either cash, bonds, or stocks. Add up all of the money you have in stock funds. Then add up all of the money you have in bond funds. Total them. Now divide the total by the amount held in both stocks and bonds. This gives you the percentages needed to do the math. Example: You currently have the following in your 401(k) plan: Growth Fund: $35,000 The first three are stock mutual funds. Divide the amount held in the Growth Fund, 35,000 by 100,000, and the answer is 0.35, or 35%. Add the next two funds, and you'll see that you have 55% of your money in stocks. The second two are bond funds, so you have 35% of your money in bonds. The Stable Value Fund is 10% of your money. It's in cash (AKA money market funds) and not invested. Pick a time frame that your 401(k) shows historical investment performance for, and that you've had your money in the plan that whole time. This example uses the last three years. The longer the time horizon, the better. Time frames under one-year are mostly irrelevant. Find the last three year's rates of returns for everything. Let's assume these returns over the last three years: Growth Fund (35%): 9% average annual return Find the average blended rate of return like this: 35% x 9% = 0.35 x 0.09 = 0.032 or 3.2% This blended rate is a 6.6% average annual rate of return over the last three years. This means every year, all of your money combined grew at around 6.6%. Use the same rate of return for cash / money market as what's shown on your 401(k) statement. If there's nothing there, then use 1% to 2% for both. Just ensure you used the same rate of return for cash used in the previous step. It's important to make sure the month ending dates are the same on your statement as shown on our web page or you'll be comparing apples to oranges, and the result will be irrelevant. Perform the math with the index rate of return numbers, using the same percentage of stocks (55%), bonds (35%), and cash (10%) held. These returns for the last three years are not the actual numbers, as they vary monthly. Stocks (S&P 500) returned 10% S&P 500: 55% x 10% = 0.55 x 0.10 = 0.055 or

5.5% Add them together: 0.055 Your 401(k) averaged 6.6% and the markets averaged 8.3%. This means that you realized an annual return of 1.7% less than if you would have just invested the same amounts in S&P 500 Index and bond index mutual funds over the last three years. In terms of money, you would have had over 4% more money ($121,136 vs. $127,024) over the last three years. So if you retired today, your retirement paycheck for life would be 4% less (instead of $1,000 a month, it would be ~$960). Because of the way money compounds, this difference magnifies greatly as time goes by. So this 4% could easily swell into the high double digits. The best way to look at things is how much the difference is in percentage terms. In this case, 6.6% is 20.5% less than 8.3%. This is an enormous percentage difference, and what's important. So it's vital to keep these numbers down to a minimum. If your rate of return is less than these blended market indexes, then you either have a bad 401(k) plan, or you chose your options poorly. In most cases, both are true at the same time. If you continue like this for over twenty years, then the amount of your retirement paycheck from your 401(k) will be about half as much as it should be. This is why all of this is so important. Your investment options should have had a higher rate of return than the market indexes. But as you now know, most 401(k) plans don't even have funding options that perform better than the markets (and some don't even have market index options at all anymore, unless you want to gamble with ETFs). This is mostly because of the incompetence of the people that put the plans together (not HR people), or because using the better performing options (or index funds) would result in them making less money, or because their company is limited to using only the poorly-performing options that their company manages. For example, a Fidelity 401(k) only offering Fidelity mutual funds. Just like everything else in the financial services industry, the whole system is "broken" and will never be fixed, so just like most everything else; it's both nobody's fault, and everyone's fault at the same time. The most important thing to remember is that nobody in the financial system is looking out for you. It's still caveat emptor in the Wild Wild West out there, and always will be. You are the only one responsible for managing all of these problems, and if you fail, you'll pay dearly for it by having much less retirement income than you planned on or hoped for. Then these problems will persist until you pass. So hopefully as you can now see, how well you manage your 401(k) may eventually be a life or death matter. About the 401(k) Marketplace for Retirement Advisers After looking at what everyone else is doing in the 401(k) market for over two decades, here's the conclusions: An advisor monthly still thinks that if they build a 401k management website, put a free rinky-Dinkytown-like 401k calculator on it, and then hold out their shingle as someone that can do administration, management, allocations, do awesome things with rollovers, or whatever - that that participants by the herds will just magically come. They didn't, won't, and never will. So the vast majority of their websites look like abandoned projects. They stopped working on it, but didn't take them down yet. So free practice management tip: Don't bother with trying to break into the market of servicing 401(k) plans and/or individual participants - at any level. That doesn't work at all in any mode whatsoever. This is because this space is already too crowded with desperate players that aren't making money from it. Then in general, the average 401(k) participant will never ever contact someone cold turkey on the Internet to hire them to do anything with their 401k asset allocations. Their no-attention-span brains are just not hard-wired for that. So even if you build it, they will not come. So don't bother as there's no way to make a dime from any of that. Even the big players that have serviced that market since day one aren't making much money. They spend most of their time calling on HR people to try to get the current 401k firm fired so they can move in. So it's all a no-win zero-sum treadmill version of Whac-a-mole musical chairs. So you'll need to do it the old fashioned hard way, via in-person meetings. This is the one and only way you're going to get people to both hire you to tune-up their 401k allocations, and then roll it over to your management when they stop working (or can escape). If you're serious about it, then you'll need to work the HR department of local companies in-person, and try to get them to let you perform financial seminars or something similar. Then if you're very lucky, they may warm up enough to talk to you about it. If you try to do this via the Internet, then it won't work because HR already has a never-ending parade of in-person 401k planners all saying showing and selling the exact same things. Everyone's 401(k) website is just another lame version of the exact same 'ol thing, so they won't even look at it on their own. If you have a deal like that where participants' feel safe talking with you about their 401k, then that works, but just a little bit. The bottom line on this market is that you'll need to be part of their "inner circle of trust, friends, and family" before anyone will do anything with you in regards to their 401k that they're currently contributing to. Breaking into that circle takes more time and work than actually doing the work, unless you can get very lucky with a local corporation. Then the actual work begins. Then you're going to have to spend tons of time swatting all of the other pesky 401k planners that constantly show up wanting to replace you. Even then, more than likely you'll spend a ton of resources at it, and little-to-nothing good will happen. The bottom line is this whole marketplace is the epitome of futility. There's just too much work for no profit. So beware of the black hole that is the 401k plan management market. We've only seen this work for one adviser over the last two decades. This was during the mass layoffs in the middle of the Great Recession. A large tech company folded, and so did their 401(k) plan. So this adviser was just in the right place at the right time to capture these free windfalls. Unless you lucked out and just happen to be in the right place at the right time (where people magically find and contact you for free about reviewing their plan), most everything to do with 401(k), 403(b), 457, and all similar types of retirement plans, is just a futile waste of resources. FYI for financial advisers - everything to do with the whole 401k market is just a black hole of hopeless futility to be avoided like the plague because people are just not wired to do anything intelligently with their money in this area. Never have been, are not now, and never will be; so do yourself a huge favor and don't even bother trying to help people with their work retirement money unless you like doing a lot of work for little-to-no money. They see their 401k as something sacred, personal, and different from the rest of their money, so their brains just don't function at all when it comes to properly managing their 401k plans (especially if it means thinking, spending money, and/or doing actual work). They see their 401k's as "something to do with work," so they think letting their employer and/or the plan manage everything (mostly on autopilot with target-date funds) is the best thing to do. Never seen anything like it in this biz, and there's nothing anyone can do, write, or say to get people to wake up and get with the program. So the best thing for your financial planning practice is to just ignore the whole thing and let people do what they want to do here, and then focus only on their non-401k investments. The same can be said to a lesser degree with 529 college plans (but here you can make a few bucks by selling the commission-based plans). _____________________________________ About when it's best to start collecting Social Security benefits |

Financial Planning Software Modules For Sale (are listed below) Financial Planning Software that's Fully-Integrated Goals-Only "Financial Planning Software" Retirement Planning Software Menu: Something for Everyone Comprehensive Asset Allocation Software Model Portfolio Allocations with Historical Returns Monthly-updated ETF and Mutual Fund Picks DIY Investment Portfolio Benchmarking Program Financial Planning Fact Finders for Financial Planners Gathering Data from Clients Investment Policy Statement Software (IPS) Life Insurance Calculator (AKA Capital Needs Analysis Software) Bond Calculators for Duration, Convexity, YTM, Accretion, and Amortization Investment Software for Comparing the 27 Most Popular Methods of Investing Rental Real Estate Investing Software Net Worth Calculator (Balance Sheet Maker) and 75-year Net Worth Projector Financial Seminar Covering Retirement Planning and Investment Management Sales Tools for Financial Adviser Marketing Personal Budget Software and 75-year Cash Flow Projector TVM Financial Tools and Financial Calculators Our Unique Financial Services Buy or Sell a Financial Planning Practice Miscellaneous Pages of Interest Primer Tutorial to Learn the Basics of Financial Planning Software About the Department of Labor's New Fiduciary Rules Using Asset Allocation to Manage Money Download Brokerage Data into Spreadsheets How to Integrate Financial Planning Software Modules to Share Data CRM and Portfolio Management Software About Efficient Frontier Portfolio Optimizers |

Tools For Money can now be reached at

support@toolsformoney.com or 707-996-9664

Tools For Money is changing. Visit our homepage for complete details.

© Copyright 1997 - 2018 Tools For Money, All Rights Reserved