Financial Planner Phone Sales Scripts, Prospect Contact Letters, Checklists, Sales Tools, and Motivational Ramblings |

| Financial Planning Seminar | Create a Custom New Prospect Binder | Other Financial Planner Marketing Tools | New Financial Planner Starter Kit |

| Site Information (is listed below. The financial planning software modules for sale are on the right-side column) Confused? It Makes More Sense if You Start at the Home Page How to Buy Investment Software Financial Planning Software Support Financial Planner Software Updates Site Information, Ordering Security, Privacy, FAQs Questions about Personal Finance Software? Call (707) 996-9664 or Send E-mail to support@toolsformoney.com Free Downloads and Money Tools Free Sample Comprehensive Financial Plans Free Money Software Downloads, Tutorials, Primers, Freebies, Investing Tips, and Other Resources List of Free Financial Planning Software Demos Selected Links to Other Relevant Money Websites

|

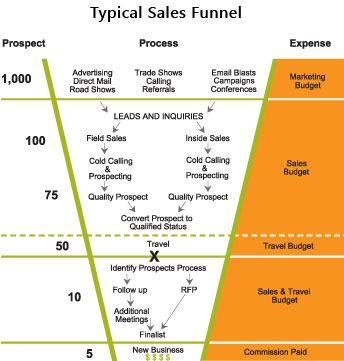

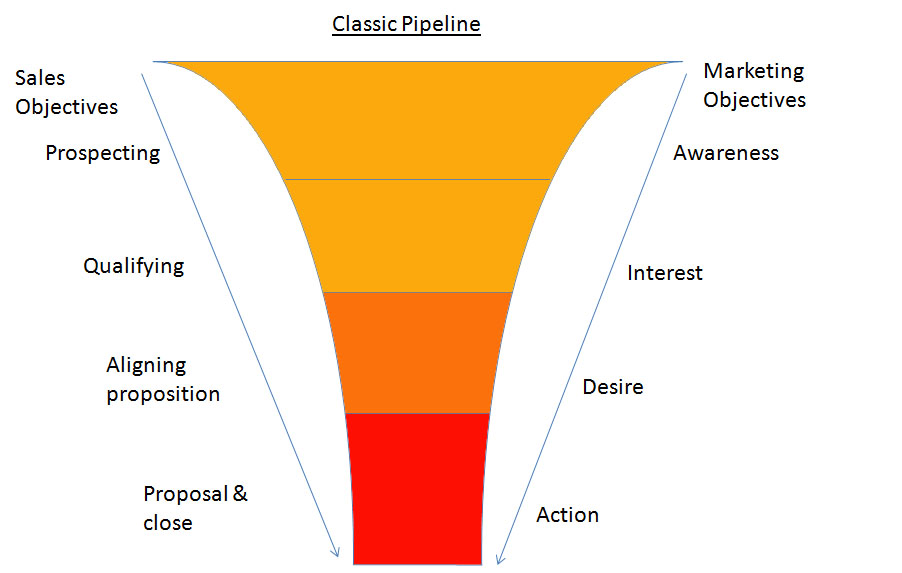

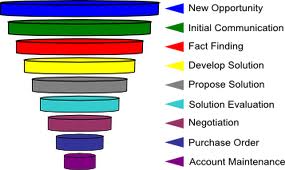

Prices and ordering information are below the sales funnel images Explanations and directions are below that Financial Planner Marketing, Prospecting, Sales, and Closing Tools to Help Keep Your Sales Funnel Full of Leads, Suspects, Prospects, and Clients These industry-specific selling tools are mostly for commission-based financial planners working in Broker Dealer mode (AKA selling loaded mutual funds and life insurance company products). There's a little value for fee-only advisors too. They are not for "consumers," unless you need inexpensive help with basic sales skills, more core motivation, or you just like sales tips in sound bite form. They're designed to help you increase your sales funnel ratios, and are old, basic, and primitive compared to other professional database-driven tracking, CRM, and marketing systems. But they also don't cost an arm and a leg and there's still plenty of value, especially for the price. These Products are Comprised of: • A few cold calling phone scripts used back in the "good 'ol days," before the advent of the government's Do Not Call List. They're designed as lame teasers to get people to agree to either let you come into their homes and/or get them to come into your office for the first "free complementary introductory meeting." • Several generic letters for sending to leads, suspects, prospects, and clients, as they progress through your sales funnel. Most are designed as pre-appointment letters to help convert suspects into prospects, to help ensure you don't screw up, and to help make it so they'll actually show up for appointments. They tell what to bring with them, give homework assignments, and in general help move them glitch-free through your sales funnel ASAP. • Sample investment newsletters so you can get an idea of what to do here. Most financial advisors or money managers send out quarterly newsletters both to let their clientele know what's going on with the firm, to keep them interested, and of course to drum up new business and referrals. So it's a natural way of course to include a piece that comments on the current state of the economy, markets, and what happened to both everyone's portfolios as a whole, then comment on what happened on an individual client basis. Since most custodians are too lame to send out quarterly investment portfolio reports these days, most investment advisers spend time and money on actual portfolio management software on their own, so they can send paying clients the actual quarterly reports they expect and deserve. • Mundane checklists to follow before you dial the phone and/or get ready / pack up to go out on an appointment. • A simple referral gathering tool that actually works. • Over two dozen pages in Word docx form (which is about 125 pages of hard copy book) of Motivational Ramblings, how to handle common objections, and miscellaneous sales tips for the financial services salesperson. Many financial sales books were read from '88 to '91 when I was in sales learning the ropes. Then I distilled most everything of value into this piece that was read weekly, to motivate me. BTW: Some of the best books on the subject were published in the last century by the late Zig Ziglar, one of the best whole life insurance salesmen of all time. Most everything is just generic, FYI, or a template and is not in a form where you can just pick it up and use it. So you'll need to edit most everything to fit your practice model. The following images are examples of sales funnels that are apropos to financial planning and money management marketing - regardless of compensation mode. The most important concept to note is that not everyone you get to enter it (at the top) will come out of the bottom. The overall goal of all of this, is to get as many people as possible to come out at the bottom. For example, in the first image, 1,000 leads went in, and only five turned into paying clients. This is close to a typical ratio in the commission-based BD financial planning business (between 0.5% and 5%). Prospecting and Marketing Tools Explanations and Directions Everything is referenced by its Word docx file name to help keep things straight. So this is a good way to tell what you'll be getting, as everything is listed below. • Appointment Checklist.docx: Use this sales tool as a checklist either before you leave the house for an appointment, or before prospects are due to show up at your office. You basically list all of the things you'd usually do to prepare, like calling to confirm the day before, packing your business card, sales brochures,

printing

Fact Finders, and loading everything into your brief case. So this will help you get all of your ducks in order so you can

sail through your Dog & Pony Show without messing up because of something mundane. What you want to do is think about all of the things you'd usually use, and then add them to the checklist. Delete all of the things that don't make sense, because they're just examples. So depending on how organized you are, you want to type in things like - get gas, don't forget your briefcase, restock business cards, print some referral gathering tools, charge your phone and computers, and don't forget to schedule the good conference room. Then always keep a copy in your brief case, taped to the wall where you make your calls, etc. • Pre-Dialing Checklist.docx: Used when making (cold) calls. This is a short lists of things to do before, during, and after dialing to have your ducks in order when the lead answers. This marketing tool is not really used anymore because of the government Do Not Call List. But it has some good basics if you're on the phone a lot. • Comparing the True Cost of an IRA.docx: One-page sales piece on the total costs of doing business with

different types of financial advisors on the food chain / pyramid. This was used in the early 90's as a fee-only planner. The point was to show people how much they'd have to spend if they didn't hire a fee-only advisor. This is so old there's probably no use for it anymore, unless you jazzed it up with modern-looking art and colors (it was made with WordPerfect on a Windows 3.1 machine, and hasn't been updated other than making it a Docx). Directions: If you're a fee-only independent planner, then you could edit this piece to fit your business and it could get the point across to some people. Then you'd give it out to people you've just met to at least have something to talk about. New Flash: Decades of hitting people up about investment costs, charges, fees, commissions, and expenses when it comes to hiring a financial advisor does little-to-nothing. It's just over the last several years that investors started caring about how much money their investments really cost them. Then these are just the minority, but very vocal, do-it-yourself (DIY) investors that have their lights fully-turned on. Tip: You don't want to spend a lot of resources catering to them because they're not going to buy anything but ETFs or index funds with the lowest expense ratios. Then they're going to be by far the "highest maintenance" clients. On the whole, investors still don't care, but for a whole new set of reasons. What they care about these days is not having to take any responsibility, not having to use up their attention spans, think, research, take any risks, do any actual work or anything at all other than write checks and watch their investments grow online and via mailed statements. So if you're out and about trying to get people to do business with you because your investment strategies cost the least, then here's another news flash - that's not going to work in a big way. You'll find some, but not many. Then these investors are just going to nickel and dime you to death, because they're on the same page as you - let's reduce all investment costs to the bone - and yes, this means they're going to start with your paycheck. So investors that care about reducing investment expenses are usually not what you want as long-term clients. It may work initially to get a small flock of people in the door to get some income going ASAP, but over time, it won't work out well. Been there and done that, and it was a major failure. What investors these days want, and what pays you the most with the least grief, is the ability and your willingness to let them dump the whole thing on your lap (piles of statements), including the responsibility for doing everything and taking all of the risks and blame, with you making all of the investment trades without having to ask, pay a reasonable fee or commission, don't waste their time they don't have unless it's important, then the ability to look at portfolios online and then just get statements that actually make sense in the mail showing constant profits (good luck with all of that!). Then they want someone to whine to when there's not constant profits. So the best clients are the ones that want to pay you to do it ALL for them. Then as long as you don't screw up, they're not going to whine when they get your bills over time. They're just going to ignore it and rarely call you about these minor issues. Penny-pinching investors do not make the best clients. People looking for a close personal life and financial advisor to totally do these annoying chores for them is what pays the best, gives you work to do, stay the longest, and give the most referrals. All of this "race to the bottom" stuff when it comes to investment expenses is a game you don't want to even play. This is for DIY investors, and they don't make good long-term clients because they're going to constantly whine about you getting paid, and they're always going to be challenging your moves and sucking your time away by having to explain every little thing you do ad nauseum. So it's best to just ignore the (ETF) investment expense ratio wars in the media. You're always hearing about this, just because there's literally nothing else to type about. • Prospecting Ideas (for planners).docx: Old list of prospecting ideas that were only a little better than cold call leads. Most probably don't work anymore because of local governments restricting access to this sort of data because of privacy concerns (there were only 386 computers running Windows 3.1, so corporations having all of your data in digital form to profit from wasn't a problem back then). • Prospecting Phone Hits Counter.docx: Used to keep track of how successful cold calling is going using a certain list of leads. For every week, you'd tally how many calls you've made daily, how many people answered, how many times you talked with the decider, then how many actual appointments you've made, and then which script and/or method worked or not. Then if you didn't make an appointment for a dozen calls, then put a "-1" input into the far right column. The goal was to stay at it until it was +4, which meant you made four appointments with new people a day. It's probably not that useful nowadays because of the Do Not Call List, but if you do things where you're calling on people, then this could help you see how well you're doing in reaching those calling goals, by keeping track of ratios and what actually worked. Where it could be used today is managing the herd of upcoming

financial seminar attendees. Then you should know that the Do Not Call List only applies to consumers, not businesses,. So you can still cold call businesses all you want to. • Referral Getter.docx: This marketing tool actually works. You'd print and give or send it to people almost constantly throughout the sales process with a pre-stamped envelope going back to you. Then every so often, if you're worthy, you'd get some back in the mail at random with free referrals! This is something every financial advisor should still be doing all the time today, as it only costs a buck. each. • Case Writing Checklist.docx: Used when working as a case writer (paraplanner) working in-person for reps. Are there even any of these real jobs left these days? • Financial_quarterback.tiff: This is an image file to help show you how the financial planner sits in the middle of the circle of all other advisors. Print it and use in your

Dog and Pony Show if you want to, and then talk about how the financial planner coordinates with all of the other financial professionals in their lives. • Choose Services.docx: A generic piece that helps get the prospect to tell you what they want you to do for them. Print and give to them during the initial meeting and then always stuff it into envelopes sent to them during most phases of the process, just like you're supposed to do with the Referral Getter tool. If someone actually circles something, then they're telling you what they want to hire you for. •Before First Appointment Letter.docx: Send something like this out a few days before you have a first appointment with someone. This reminds them about the appointment, has your contact info, time of the meeting, directions to the meeting place, and generic sales fluff (like stuff to bring via the Homework piece). • After First Appointment Letter.docx: This is an example of a contact letter that you should sent to everyone you have a first appointment with. Send it out the same or the next day after the appointment, so they'll get it ASAP after your first meeting. To repeat, whenever you send anything in the mail both Choose Services.docx and Referral Getter.docx should go with it. Also, tell them non-generic information, like you're going to do what you said you were going to do in the appointment, and then remind them if they have any homework to do too (so you could send Homework for First Appointment.docx too). • Approval to Sell Stocks Letter.docx: This is self-explanatory. If you're with a BD, then you probably do not have "full discretion." This means you can't just buy and sell investments in client accounts without getting permission first. So this is a sample letter to send to investors to have them sign and send back to you giving you this permission. • Level of Services.docx: Use this piece to tell prospects what level of financial planning and/or investment management services you'll provide. This usually depends on how much money they'll be paying you in one way or another, so you'll have to edit this to fit your practice. Just tell them, "If you let us manage $X then we'll do all of this for you, and for $Y, then we'll do that plus this." This piece is usually used in person, but it may find use in a letter or handout before the first appointment. It also doesn't hurt to send it again after the first appointment. This sales tool will help you gather more assets the client may be "hiding" from you, because when they realize they'll get more from you if and when they pay you more, they may "remember" that they have more for you to work with than they initially said. • Homework for First Appointment.docx- Include in the pre-first-appointment letter, or others if needed. This is a checklist to remind people to bring documents with them to meetings. Edit the list to fit your practice. There's also a goal section on the second page to get them to write out their short-, intermediate, and long-term financial goals. There are directions on the piece and most of it is self-explanatory. • Independent Philosophy.docx- This two-page piece is about some of the advantages of working with an independent fee-only financial adviser, from the clients' point of view. So if you are one, then just edit it to fit your practice and include it in most all mailings. • Mailbox Stuffer.docx: This prospecting tool may be of use if you have any interest in going around physically and stuffing them into people's mailboxes. If you target the right area and edit it well to fit your deals, then you may get some leads (without having to spend money on "mailers"). People will see that it wasn't mailed, so someone actually stuffed it in there, so they'll tend to read it more than junk mail. Laws change, so check with the Post Office to see if this is still okay. • Post First Appointment Letter.docx: This is a generic letter you'd send to prospects after the first appointment. There's not much here, just a thank you, then you make your list of questions you'll need answered before the next appointment so you can make your financial plans. • Pre-Plan Presentation Appointment.docx: This is another generic letter you'd send to prospects before the financial plan presentation appointment. There's not much here, just a thank you, then you'd make your list of questions you'll need answered before the appointment. • Prospect Call-In Letter.docx: This is another generic letter you'd send to prospects if they call you or return something in the mail. Basically, thanks for contacting us, here's more generic sales fluff, and either we'll call to make an appointment or it's a reminder of when and where the next meeting is. It works well to send to people that have initially responded to your

financial seminar marketing. • Second Appointment Letter.docx: This is a sample letter to send to prospects after the first introductory appointment and the second fact finding get-to-know-you appointment. It basically says that this appointment will take much longer than the

Dog & Pony Show appointment, and then here's homework to do to prepare, and the appointment is at this time and location. • Send After Not Making the Sale.docx: A short letter to thank people for listening to your Dog & Pony Show, but not wanting to proceed with the process. We usually included the Financial Planner Evaluation.docx piece too, in hopes that they'll return it, so you can learn from your "mistakes." • Financial Planner Evaluation.docx: A generic form to get people to tell you how you did, how you can improve, and what financial topics they're interested in. • Send Letter After Meeting Referral Letter.docx: A short thank you letter to send to clients after they give you a referral, and you've actually met with them. • Sending a Fact Finder Letter.docx: Add some relevant text and send this letter with a Fact Finder and a self-addressed postage-paid envelope. Hopefully they'll fill it out and return it, so you can proceed with the process. • Suspect Letter.docx: A sales letter to send to people that you think may be a prospect. It goes on about how the fee-only business model is the best and knocks the other ways of getting paid (which rarely works). • Newsletters: Several samples of newsletters that financial advisors send to their clients periodically. They just show some examples of what is usually sent. • Scripts: Any Warm Body.docx: This is a default generic old hat cold calling script for calling anyone. • Scripts: Generic Fee-only Script.docx: A default cold calling script for fee-only advisors. It has some comeback suggestions to say when needed and has a small section with things to say when people say they're already taken care of, aren't interested, want to think about it, etc. • Scripts: Old Hat Script.docx: This was the default generic old hat cold calling script for talking with a suspect to try to get them to meet and turn into a prospect.

"Old hat" means something that you're very used to because you've done it for so long and have worked the bugs out. • Scripts: Recent Death Referral.docx: Generic sales script used to get people that gave you referrals related to people that just died to meet with you. You used to be able to just keep tabs on the local obituaries and then cold call, but that was the last century. • Scripts: Recent Death.docx: Generic sales script used to get people related to people that just died to meet with you. The problem here is that it takes a year or two for heirs to get their inheritances. • Scripts: Recent Marriage.docx: Generic sales script used to get people that just got married to meet with you. The problem here is that newlyweds tend to not have enough money to work with. • Scripts: Referral Script.docx: Warm calling a referral for the first time sales script to get them to come into the office for the first "free introductory meeting." • Sales and Marketing Motivational Ramblings.docx: These are THE big gold nuggets of wisdom in this bundle of sales tools (29 pages full of gold sales and life management nuggets, which is about 125 pages of a normal hard copy book). Over 2,000 hours went into this for over a dozen years. This could be a 500-page hard copy, "basic life and sales skills for dummies" book, but there's not enough money in that since the advent of self-published "eBooks," where everyone on the planet "has a book out" (and then it's free or only a buck). When I made the transition from reclusive Silicon Valley engineer to salesy people person in '88, I read just about every sales book out there (when I should have been dialing for dollars!). This was in addition to our Waddell & Reed sales managers, whom I have to give credit here, as they were awesome at this. They basically trained us how to "sell ice to Eskimos." I constantly made notes and condensed huge complex concepts into sound bites. The whole point was so I could read something in less than an hour to motivate me to change my life from loser to winner. So whenever I felt down, I'd read this, and then I'd be back at it again fresh the next day. So there's many tips on basic life management, motivation, prospecting, sales, comebacks, marketing, and especially closing the sales deal. There's content to take a "slacker loser" and help turn them into a lean and mean salesperson over time. Major life-altering brainwashing was needed for me, and this kept me on track when I wanted to give up. (which I ended up doing anyway a dozen years later, by giving up being a financial adviser and making this site!). Basically if you have a "job" where you work at something where you make a living "selling stuff" to others (or just having to constantly convince others that you're right and everyone else is wrong, like just about every attorney in court, CEO, politician, doctor, or leader of any kind), then there's all kinds of life-changing tips in these self-motivational pieces. These are a must-have if you are a "sales manager" of any kind, where it's your job to grow a force of sales people out on the front lines of business war. Whenever someone comes to you with a challenge in this area, there's probably a section that has something to do with resolving it. Below is a "teaser" from both Sales and Marketing Motivational Ramblings.docx and Life's Rules in Concrete: How to Use Self to Control Mind.docx (which was the second half of the Ramblings, is too personal, not meant for "normal people," and is no longer for sale): Remember that these are only generic selling tools. Just like a mechanic's tools or an artist's brushes, how well they'll work totally depend on how well you can use them. So without further ado,

here's my attempt at something that's near impossible to explain without writing a 1,000-page book: Your core motivation, prospecting / marketing / sales skills, actually doing your job; and then skill at closing deals totally depend on YOU. These are all things at the "soul-level" that you can't outsource or have someone else do, so these bucks stops with you and only you. Being a salesperson is a major personality disorder. If you're a natural born people-person, then most of this sales stuff is probably second nature to you (and the hard part of this business

is learning the technical details of actually doing your job - like how to use computers and

financial software). So you're wondering, "What's all of the fuss about... sales skills? All you do is tell people what you do, invite them in for a free initial consultation, get to know what they need, and then sell it to them. Then you just do the paperwork, invest their money, and do maintenance. It's as easy as falling off a log. My big problem was passing the Series 6 exam and then trying to figure out how to do something better for people than selling

American Funds and

life insurance company products!" But if you're not someone that just loves constantly being with and helping people in-person (like me), then "sales" may be something that; regardless of how "smart" you are, you'll May just never be able to learn. Few normal people can do it, because it's just that hard and painful to get that part of your brain to function properly. But guess what? If your inner core self is strong enough, then these skills ARE something you can learn - just like anything else (like taking public speaking classes). All it takes is training to get onto the right path, beef, and then practice. Then once you get it after doing it dozens of times, you won't have to spend time learning how to do it anymore. It will just be part of your core programming. Also when you finally understand that all there is in life is self, mind, and body; then you can learn to deal with, and cultivate, these three things individually and separately. Then you can learn to control self enough to control mind and then control mind enough to control body. Only then can you start strengthening your inner core self. Then, when you're strong enough, you can change your mental mode from one of "scarcity" to one of "plenty." Then when your core is strong enough, and you live in a world of "plenty," you can finally overcome the "pain and suffering" of living your life as a salesperson. Then all of the mundane failures, stupidity, obstacles, objections, rejections and annoyances that come with a life in sales will be an amusing and expected matter of course, instead of the boogie man slowly eating at your core until you give it all up for good. Then and only then will your "job" be as you initially imagined. This is probably what you imagined when someone that wanted your money (BD) talked you into getting into this industry: You go through the initial pain of paying money to learn and pass exams and make it through all of the BD's hoops, and finally you're a "financial planner." Now what you expected is that you should be able to just hang your professional shingle out, and the world will just magically flock to you, where you can just suggest investing in this and that, and they all just magically say yes, write huge checks, the paperwork and trades go through without problems, then everyone will be well taken care of, then you can just sit around in your easy chair making the big Wall Street money just by

reading the WSJ and tinkering with investment portfolios. Ha! The reality is the exact opposite of that "dream job." THE problem, that your BD also ignored (because they get paid whether you succeed or fail), was all of the required "basic personality programming" to be a successful salesperson wasn't done first. The proverbial cart was put before the horse. Your fundamental foundation needed to support everything else was not even built. This wasn't helped by your BD having to give up on its sales training programs, because they're barely surviving the 21st century. They want you to succeed, and want to train you to "do things their way," but the money and resources are just not there to help you anymore. So you piled on tons of time, work, expenses, exams, FINRA, BD, compliance, prospecting, marketing, sales, closing, objections and rejections, paperwork, having no clue how to do your job yet (investing people's money and/or

perform actual financial planning), and all of the other never-ending parade of "minor failures." Now it's only a matter of time before these two forces converge - all of the investment you put into getting into the biz and not having enough core strength to build a foundation strong enough to transform self into a salesperson. Then everything imploded on you from the weight of everything that was piled on top of your non-existent foundation. It's just like trying to build a house on sand. The outcome was inevitable, because once your BD "starts the clock ticking" (you have so much time to make so much money, or you're fired), then it's just a matter of how and when everything will collapse (you'll be fired or will quit). This was the nature of things in the last century, and it remains today, only much worse. The average tenure of a newbie BD Rep is less than one-year (down from 2.5 years back in the last century). The reason for one of the highest failure rates of any industry ever usually boils down to just poor marketing, prospecting, sales, and closing skills. Then this usually boils down to people with accountant personalities trying to be an opposite version of who they really are. Inner core self was not first strengthened enough to be re-programmed into a salesperson. So what usually gives out first when these two worlds collide, is the willingness to continue. The logical training, knowledge, skills, and ability are still there, but the willingness is not. All of the tools and infrastructure was invested in, creating adequate ability to do the job, and perform the required functions, but when faced with the Real World "challenges" of actually doing it day in and day out, your core ran out of life, so you had to fire yourself. Even if the rookie Rep passes the BD's "training programs" with flying colors, does not mean they will actually pick up the phone and "dial for dollars." Even when all of the required money tools are laid out in front of them (which are all

available for sale on this site), they just don't have the willingness to pick them up and use them when the make-it-or-break it moment happens. These moments happen constantly in life to everyone, not just salespeople. For example, there's usually a magic moment when you've convinced someone to come in to endure your

Dog & Pony Show. But you blow it by not closing the deal, then the moment passed, and your prospect slipped away, that's it forever, and you have no idea why. And this was because all you needed to do was break out the "Old Hat Script" closer tool during the magic moment and say something as stupid as what 20th century W&R training taught. The tool for that was right there in your hand, but you just didn't have the willingness to use it when the job presented itself. You balked just because you were "lame." For example, "Come on in to my office and I'll share some ideas with you on how to lower your taxes, make more money, and change and transform your life for the better? What's best for you, Tuesday at 6PM or Wed at noon?" Then all you have to do is shut up and wait for the answer. It doesn't matter how you feel about it or how stupid it sounds, all that matters is that you actually pulled out a tool that was designed to do that job, and used it right at the magic moment for a change. You didn't do that at the magic moment, so you lost. It's just as simple as that. No rocket science was needed. This is all basic grade school level stuff most of the time. The people-person did this immediately as a matter of course, without even having to think about it. The accountant was stuck over-analyzing the situation, probably deciding which tool to use or the best way to say the words, and lost out because magic moments only last a moment, then they're gone forever. Most of this whole business just boils down to one mundane thing: When an opportunity arises, you open up your financial toolbox, grab the right tool for the job at hand, and then use it on the spot. It doesn't need to be the best, cheapest, easiest to use, slickest, or most popular tool. All that matters is that you brought out the right tool to do the right job at the right time, and asked for the business. It's usually just as simple as that. Look at the whole biz like you're a handyman being shown all of the work that needs to be done in a house by the landlord. The landlord points to something, and then says,

"Can you fix that?" The only right answer is, "Yes sir, I always have the tools that do those jobs, right here in my toolbox

(sample financial plan), see look for yourself." When the landlord points to a nail sticking out and asks if you can fix that, you're supposed to just open up your toolbox, pull out your hammer, and say, "Yes sir, here's the tool for that. It's not the newest, the biggest, easiest to use, nor the best, but I'm here right now willing and able to help you with your problem, so just agree to pay me and I'll pound that nail in to your satisfaction right now, sir." Anything other than that, and that magic moment passed, so you're fired by not being hired... next!! The point is that there's tons of little tiny jobs that need to be done before the landlord will pay you to do the real work. All of them need to be done well to not get fired. So always "closing at the magic moment" is essential for success. Always keep your "ABCs" in mind - Always Be Closing. In the landlord example, the handyman initially closed the deal at the magic moment, or he would not have been invited into the house in the first place. So as you can see, from the very first step in the process to the very last, there's magic moment after magic moment that all need to be dealt with by using the proper tool. There's magic moments when you just meet someone the first time (on the phone or in-person), when people both make appointments and then show up for appointments, when you're presenting your Dog & Pony Show, all through

the fact finding process, making their financial plan, presenting the plan, convincing them to buy into your

investment strategies, closing the deals (getting them to write checks and sign paperwork), monitoring and updating, and then asking for referrals. The point is the average rookie BD Rep usually fails to perform these mundane functions when needed, and then in no time at all, goes back to, "You want the combo meal?" All usually just because of just ONE THING - failure to break out the right closing tool to do the job right the first time at the right time. The right tool wasn't pulled out at the right time mostly because you didn't transform self into a salesperson yet. And this foundation wasn't even built because you didn't build core inner strength needed to change your life yet. And this wasn't done because this is the first you've ever heard of such things. You didn't even know the basic life concept that life is basically just self, mind, and body. Or if you do know, then you're still in the primitive mode of letting mind and/or body control self (and/or letting body control body). You can lead a horse to water, but you can't make it drink. You can give anyone the tools to do a job, but whether they'll actually pick them up and use them is a completely different story. There is either someone home at the core driving self, or not. Successful people "hit the ground running when the starting gun goes off," whereas failures were so startled by the starting gun that they froze up like a deer stuck in headlights. Your core being either "has it" or it does not. It either knows to use the tool or it doesn't. None of this is magic, it can all be learned if you're strong enough. Several would-be employees here didn't get hired for one simple reason - they had the time, looks, voice, skills, health, need, brains, and ability to do the jobs, but not the willingness. So they just lacked what's commonly called "intestinal fortitude," or they just had a "weak constitution." It's all the same thing just using different words to describe what's at the heart of your core being. So the piece "Life's Rules in Concrete: How to Make Self Control Mind" is (was) all about first developing the basic fundamental foundation needed for developing your core inner strength. Then the piece, Sales and Marketing Motivational Ramblings will make sense, and just reading it will help replenish your core. To accomplish just about anything significant in life, there has to first be someone home deep inside you that's driving everything else. Without self having the strength to drive mind and body, then nobody goes anywhere or does anything (but sit around playing video games, or watching Dancing with the Idols on TV). So if you're one of the thousands of "ex-CFPs" that got tricked into thinking this financial sales business would be an easy path to getting rich quick, and then you "flunked out" the day the clock started ticking, because you

couldn't get anyone to sit long enough to listen to your story (or as I like to call it - your Dog & Pony Show); then these basic malfunctions in your underlying fundamental systems are why. You had everything going for you but the ONE essential and most important ingredient - core strength, motivation, and the ability and willingness to give self enough power and control to drive everything else somewhere it decided to go. Everything stems from your core. You didn't first develop your core self. You accumulated all of the tools, but there was nobody home to use them. So you just put the cart before the horse. Feeding the horse needs to come even before building the cart. Before undertaking any type of "sales job," you first need to have a solid core. Nobody ever told you that, huh? Then that's why you "failed in sales." Then you looked around at all of the "idiots" that did make it, and wonder why. They "don't know" 1% of what you know, they didn't get any help or training, they have and use inferior money tools, they wear poor clothes drive a clunker and don't have a rich firm to back them up, and basically suck as people, whatever. As you mature, you'll realize that most all of that matters not when you're "in sales." What matters most is your ability, tenacity, persistence, willingness, and motivation to succeed. And all of that comes from only one place - your core self. And most of that comes from your parents and/or generic upbringing and culminations of life experiences. You're either an ambitious "go getter" or "self-starter," or you're not. This is not something you can buy, get handed to you for free, or learn in a normal college. You pretty much have to figure it out on your own via failures stemming from the School of Hard Knocks. Once you realize what's going on, only then can you take concrete steps to develop it. The only one that can do all of this for you is YOU. Here's a source-less definition of the difference between persistence and tenacity: "Perseverance commonly suggests activity maintained in spite of difficulties or steadfast and long-continued application. Endurance and perseverance combine to win in the end. Persistence implies unremitting (and sometimes annoying) perseverance: persistence in a belief; persistence in talking when others wish to study. Tenacity, with the original meaning of adhesiveness, as of glue, is a dogged and determined holding on. Whether used literally or figuratively it has favorable implications: a bulldog quality of tenacity; the tenacity of one's memory. Pertinacity, unlike its related word, is used chiefly in an unfavorable sense, that of over-insistent tenacity." More similar clichès: "...the world is full of poor educated idiots. ...persistence is the ability to keep doing something even after the initial motivation to do it has ceased. Talent, money, education, skills, experience, good looks and all of that don't amount to a hill a beans. It's persistence and only persistence that will make or break you over time." When your core is strong, having persistence is just a matter of course. It's just already there and does its thing on its own all by itself. But when your core is weak, persistence is an arduous chore. You have to consciously force yourself to be persistent. This only drains what little core you have, so it eventually peters out until you give it up and go back to doing something self can live with comfortably. Knowledge IS power, but it's mostly useless if you don't use it. In order to use it, you usually have to tell people things of value they didn't know, so they'll pay you for it. So it's all about using it to help others. Then others can't or don't want to listen, nor change, so you'll have to constantly be persistent. Sorry to disappoint you, but that's just the way life works as a primitive human in a complex world. So you'll need to be persistent to get people to even remember you. Then you'll have to tell them the same things over and over and over again until they understand finally get it. So like it or not, it doesn't matter how much you know, what matters is how good you are at getting people of all personality types to go along with you, or follow your lead. So in order to get to the point where you can actually use your knowledge, you have to use several closing tools to be allowed to pass through every magic moment. And you didn't get to pass the first time you tried to use a tool either, then you had to do it more than once. This is being persistent. If you don't succeed the first time, try try again. Once you learn how to pass through all of the magic moments, then using the right sales tool at the right time will become what W&R training used to call, "Old Hat." The concept is your oldest hat is the most comfortable, so whenever you're flummoxed by something, the best default sales tool will always be your "old hat." If you can't decide which tool to use in the few milliseconds you have to decide, then just put on the old hat. So it's critical that your core self can regurgitate all of your old hat sales scripts at a moment's notice, regardless of the situation. If you don't know what to do or say, don't even try, just default to using your basic tried and true old hat tools. The goal is to become what's called a "subconscious competent" when it comes to using your old hat sales tools. The words should just flow from your tongue as comfortably as telling your mother you love her. Then once your core self gets all of that down, then and only then can you effectively test and use variations of old hat. This is how you "mass produce" your deals so you can help many more people. As the late

Zig Ziglar

sort of said, "The only way to make the big money is to have something of value that helps people's lives that makes a little bit of money, and then get many many many people to buy into it." So you could have the proverbial wisdom of the ages all in your head, but if you keep it all to yourself and don't "spread the word" then you won't make a dime from it. Just about the only way to get rich (other than dumb luck, inheritance, screwing others over legally, or by crime) is to find something that makes a little bit of money, and then mass produce, market, and sell it. The late Zig did that with life insurance sales, and is still probably the all-time king of face value sold on the planet. Then this site is proof of this old Emerson saying - "Build a better mousetrap and the world will beat a path to your door." But then they teach in college that if nobody knows about your world's best mousetrap in the first place, then it can't and won't sell. In other words, once you've invented the mousetrap, then it's ALL about getting the word out via marketing and advertising. So even if you have something awesome everyone is willing to buy, if you don't pony up the "advertising" (your mouth) then it will all be for naught because nobody will ever know. That's just the way the world works. It doesn't matter to anyone if you're the best at anything or not. If "the media" doesn't catch on, and tell the world with, "Hey everyone, you need to check this out," then nobody will know, nor care. People only care when other people in their world tell them they're supposed to care. Nobody can figure out anything on their own anymore, they couldn't before, and they never will in the future. That's why most everything in life is so mediocre that it makes you want to puke (e.g., Justin Beiber, Kardashians, Lady Gaga, American Funds, etc.)! The media doesn't care unless they get paid off by someone, so they're not going to tell everyone how cool you are unless they're fed adequately. So when the new Justin Beaver comes along, he's ignored until someone adequately feeds their system. Then when the system is fed, they tell everyone in the system, that this is whom we're supposed to promote and pay attention to now. The point is that whomever or whatever is being touted as being cool at the moment has little-to-nothing to do with their actual talent, or value to you. It has EVERYTHING to do with HOW PERSISTENT the talent is at getting noticed, and then how much resources they can drum up to feed these systems. So the bottom line is this life lesson: Being the best at anything doesn't matter at all to anyone - unless you're willing to persistently and constantly feed the system with massive amounts of advertising money (or similar resources) to get your word out. Being mediocre and adequately feeding the system will do something. But if you want to win at something, and you're only mediocre, then you not only have to feed the system all day every day forever, but you have to be persistent at it all, by feeding the system much better than anyone else is doing. The squeaky wheel gets the grease. Examples of this are ETF marketing, American Funds, and

annuities. American Funds is the epitome of being mediocre, yet they're one of the top mutual fund families in terms of assets gathered. Why? Because they've adequately overfed the promotional systems for decades. Then the system did its job of telling the world that American Funds are the best thing since the invention of the wheel. So everyone being pretty much brain dead, and doing absolutely nothing to determine if any of the advertising is even remotely true, just goes along with it - "Well I see ETFs, annuities, and American Funds being talked about and advertised constantly, so they must be good, so I just gotta get me some of that! I don't see anything else being promoted, so therefore everything else must be

crap, so I'll just ignore it all... baaa I'm just a sheeple, shepherds please lead me blindly to my fleecing." So the bottom line on that rant is that it doesn't matter how cool you are. All that matters is that how persistent you are at telling the world how cool you are. If you're out at it every day, then enough people will care enough so you can make a marginal living. But nothing big will ever happen unless you have the resources to adequately feed the system. The one and only way to get the word out without spending bazillions in ads is to just be persistent in your world. Then it doesn't matter if you're great or you suck, if you say the same things over and over and over to your flock of sheeple, eventually some will believe it. All you need is to be persistent enough for people to believe you in your little world to make a living at whatever it is you're doing. Another example is this site. The system knows there's some of the best stuff ever created going on here, and then they try to get us to feed it by offering radio and TV spots. So I say, "Wow that's great, how much does that pay?" Of course the answer is always, "You have it backwards, you have to PAY BIG MONEY to get to be on TV or the radio!" So that was the end of that. Then the system went back to ignoring the whole thing because it knew it wasn't going to get fed from it. Nowadays, the whole Internet is just one ginormous game that can't be won, as it's rigged by the top few major players (then the government even tries to stop it here and there, and fails miserably every time, so it finally quit trying around 2012). So as you can see, being mediocre and persistent at playing everyone's (advertising, and now social media) games is the only way things work. Being awesome and not being persistent (by not feeding the system) does not work - regardless how awesome you are or how much the world needs what you have more than the mediocre players. So you do not have to be super awesome to succeed in this business, or anything else in life. All you have to do is be mediocre, and then play the game right by feeding the system,

while always being persistent. In other words, you need to persistently feed the system in order to get noticed. So just because you've invested in acquiring all of the best technical money tools (the mousetraps) to do your jobs, does not mean that people will flock to you just because you can hang your shingle out as a licensed Rep and can actually do the work better than your competition. Nobody will ever do that, so it's best to get over that dream ASAP. You're going to have to dig deep into your core self to find the strength to get the word out to others. In other words, you're going to have to go out into the Real World and sing your song to the masses in order for anyone to even pay attention to you. Then you're going to have to pay attention to who is paying attention to you. Then you'll need to decide if they have jobs you can do for a profit. Then you'll need to figure out if they can afford to pay you or not. Then you're going to have to use all of your sales tools so you can pass through all of their magic moments. Then after all of that, and much more, you can get down to actually doing the job you signed up for as a financial advisor. Not just once, but all day every day, persistently. Nobody told you that you'll be spending less than 10% of your time actually doing your job, huh? A quarter of your time will be spent finding people to talk to, a quarter playing phone tag and talking to them mostly about getting together for meetings and closing your deals. Less than 10% of your time will be spent actually doing financial planning and investment management. The rest will be spent on preparing to do your job, and fixing yours and others' never-ending parade of screw-ups and failures. Not feeling so great about all of this now, eh? Your core is already depleted just reading this rant, huh?? Well it's best that you find all of this out now rather than after you've invested your life's blood into it. So everything in this business stems from your core self. Without that, you're just a zombie - a warm body flailing around aimlessly in search of brains. There needs to be someone at home deep inside that knows the basic concepts of life in general, knows the risks vs. the costs vs. the benefits of doing this kind of work, and then is willing to constantly fight against the never-ending parade of unbelievable stupidity in order to someday be able to have self drive body and mind to a better life. So another bottom line is that if you're just an average person with little-to-no "connections" or resources, then your success or failure in this business, and in life in general, will be determined mostly by your core inner self serving as decider, guide, and driver for your mind and body. So if you're not a natural born people-person, or if you don't have this core strength, and/or are not willing to do the hard work to develop it, then you are just in the wrong business! So you should get out ASAP and go back to saying "paper or plastic" or just counting other people's beans as a low-paid CPA, or whatever slightly better than minimum wage job you've been working at as a salaried or hourly wage W-2 employee. If there's no change in your core, then there will be no change in your life, it's just as simple as that. Your life will never change if you don't have "core strength" driving it. Everything of real value in life stems mostly from that. There's also not going to be a magic event in your life that just magically makes everything comes together and then everything will work out just fine. Just the opposite, without a solid core, your life is just going to be like it is now. Then it will slowly get worse, then you're just going get old, sick, die, and that will be the end of that. My sister the "Reiki Master" thinks that the great universal oneness, or whatever, will infuse us with life energy, take care of us, and then save us. That's total nonsense. The universe is trying to kill you every second of every day via a force called "entropy." Then she died a slow painful death from cancer. So get over all of these kinds of cop-outs and wishful thinking that's designed to get you off the hook for not taking responsibility for your own life and future. It's just you against the world, or it will be here and there, so it's best to just get over all of that ASAP. All of the following concepts are total bunk, will empty your core, and are the exact opposite of how life actually works in the Real World: Destiny, everything happens for a reason, fate, everything will work out in the end, karma, God has a plan and works in mysterious ways, etc. and so forth. If your core self believes in any of the above bull, then you have tons and tons of long hard work to do if you want to have any hope of surviving this business in the Real World (or just about any other industry or business where you can earn much more than it takes to barely survive). This is what some of these sales tools are designed to help you do. If you've chosen not to fight, then you've resigned to losing in life.

"God only helps those that help themselves. Be a doer and not a taker." If you want to stick out and get noticed, then you have to take risks by stepping up and speaking out and accept the all of the failures that come with it. Yet another news flash - in sales, you're lucky if 10% of your efforts are rewarded by actually getting paid. How's your core feeling now? Not as tough as you thought, huh? Get used to and over it, or it's back to your day job you go. It's much easier to endure all of that when you know how to strengthen your core to the point where you fail constantly, but don't care and press on anyway (this segues into the concept known as "plenty vs. scarcity"). Then when your core is depleted, knowing how to replenish it is also critical. So regardless of your age, you can start a better life by first realizing that you do have a core inner self. Then get in touch with it. Ask it all of the big meaning of life types of questions. Then send it to college. Then when it's strong enough, go out and DO something... anything. Just be prepared to fail, over and over again, before you realize any success. Why? This isn't the 20th century anymore - it's the 21st. It's a whole different and broken ballgame now - and getting worse daily. Okay enough for the freebie demo, you either get it enough by now, or you don't. If you don't then that's fine too. Most everyone is basically a sheeple follower (and not a shepherd leader) nowadays, so you're in good company. If you have a normal non-sales job, then good for you, you don't have to be concerned with any of this stuff. This is all for "doers," and not for "plodders." It's only for people that want to do big things to make big money, change the world, and/or just do something with their lives other than "just being a useless warm body that sucks air" (this is what W&R training said you were if you didn't make it in the 80's). The piece Sales and Marketing Motivational Ramblings.docx summarizes several different versions of "personality types" and the best ways to sell to them. So don't feel bad if you're a plodder, you'll probably have a much happier life than most "rich people" - which has been my experience living in the Real World. Like they say, some of the happiest people are those that are totally clueless and just perform simple manual labor for living, then go home to their families, and don't do anything but sit on the couch getting fat playing video games and watching Dancing with the Idols. So don't feel bad if that's you, if you're happy with just that, then good for you. If you have a normal life and a good job, and that's all you want, then you're in luck - you don't have to go through all of the pain and suffering of learning any of this to succeed - because you already did (as long as you don't lose your job or health insurance, huh?). Just be happy being normal, it's much easier. But if you want any more than that, then just be warned that it's way more time, work, money, and grief than you thought - waaaay more. This isn't the 20th century anymore. It takes much more of everything just to do the same things as it did back in the good 'ol days. If it took X amount of resources in the 20th century to start an enterprise and make it profitable, then it takes 3X to do the same thing nowadays. Then it gets worse all the time. So if your core isn't strong, and/or you don't care, then just be happy being normal (not being "in sales"). The free life advice here is to not make the mistake of thinking you can quit your job and become a financial planner, or anything as challenging as that or more, because you will probably just fail miserably. Then because of the "state of humanity," that will probably be the last huge mistake you'll ever make (because you'll probably eventually die from it). A motivational book about all of this was on the list of things to do for years (combining these two pieces), until it became clear that

selling books makes no money anymore. Here's another free life tip I'm passing along after getting to know a couple best-selling authors, and from my experience selling my

Money eBook. It's only the paid book signings, seminars, and public speaking that actually makes authors any money. The publisher is the only one that makes money by selling the actual hard copy books. So the bottom line tip, is that there's no money in writing books anymore, period. When these concepts were presented to me, I was young and very naive and thought everyone either already knew all about this, or it was basic-ed that I'd soon learn in college. It turns out that only a few people know anything about this stuff, and then those that do are not talking about it (for example, I've known all of this since the late 80's and it wasn't until 2014 that I decided to put it on the site for mass viewing). So you've never heard about any of this because people do not want to let the information out to the masses. If everyone knew, or there was a standard place to learn, then many more people would be salespeople. Then the people that already know this stuff would have more competitors, and thus would be making less money. So nobody is going to tell you any of these gold nugget life secrets, unless you pay for it. There's hundreds of gold nuggets like this on the site, so if you want to discover them, then all you need to do is

read. Simple as that! |

Financial Planning Software Modules For Sale (are listed below) Financial Planning Software that's Fully-Integrated Goals-Only "Financial Planning Software" Retirement Planning Software Menu: Something for Everyone Comprehensive Asset Allocation Software Model Portfolio Allocations with Historical Returns Monthly-updated ETF and Mutual Fund Picks DIY Investment Portfolio Benchmarking Program Financial Planning Fact Finders for Financial Planners Gathering Data from Clients Investment Policy Statement Software (IPS) Life Insurance Calculator (AKA Capital Needs Analysis Software) Bond Calculators for Duration, Convexity, YTM, Accretion, and Amortization Investment Software for Comparing the 27 Most Popular Methods of Investing Rental Real Estate Investing Software Net Worth Calculator (Balance Sheet Maker) and 75-year Net Worth Projector Financial Seminar Covering Retirement Planning and Investment Management Sales Tools for Financial Adviser Marketing Personal Budget Software and 75-year Cash Flow Projector TVM Financial Tools and Financial Calculators Our Unique Financial Services Buy or Sell a Financial Planning Practice Miscellaneous Pages of Interest Primer Tutorial to Learn the Basics of Financial Planning Software About the Department of Labor's New Fiduciary Rules Using Asset Allocation to Manage Money Download Brokerage Data into Spreadsheets How to Integrate Financial Planning Software Modules to Share Data CRM and Portfolio Management Software About Efficient Frontier Portfolio Optimizers Calculating Your Investment Risk Tolerance |

© Copyright 1997 - 2018 Tools For Money, All Rights Reserved