When is the Optimal Age to Start Collecting Social Security? |

| Menu of Retirement Planning Software | Articles about Social Security |

| Site Information (is listed below. The financial planning software modules for sale are on the right-side column) Confused? It Makes More Sense if You Start at the Home Page How to Buy Investment Software New Financial Planner Starter Kit Professional Investment Portfolio Building Kit Financial Planning Software Support Financial Planner Software Updates Site Information, Ordering Security, Privacy, FAQs Questions about Personal Finance Software? Call (707) 996-9664 or Send E-mail to support@toolsformoney.com Free Downloads and Money Tools Free Sample Comprehensive Financial Plans Free Money Software Downloads, Tutorials, Primers, Freebies, Investing Tips, and Other Resources List of Free Financial Planning Software Demos Selected Links to Other Relevant Money Websites

|

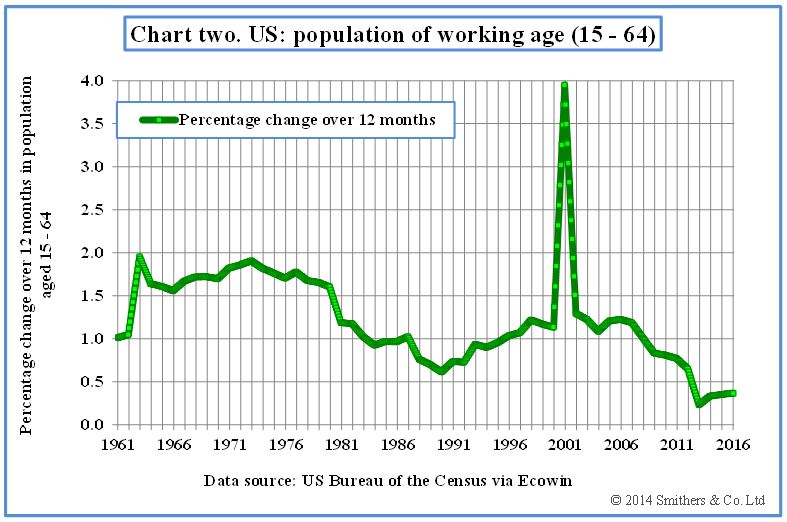

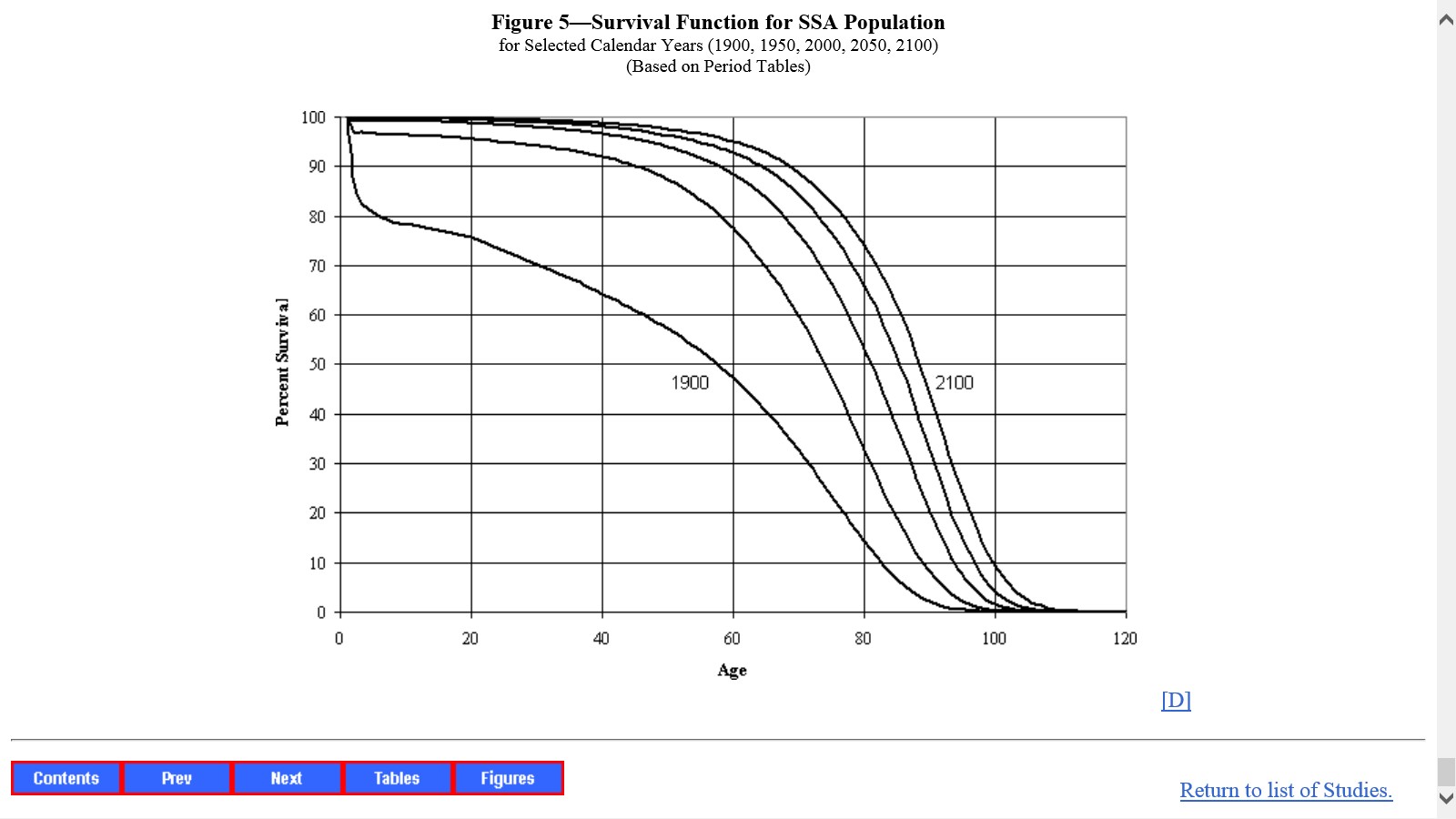

This great debate is about the optimal age to start collecting Social Security retirement benefits. The naive argument is for waiting as long as possible, because benefits go up as your age increases. This retirement planning analysis proves you should always take your retirement benefits as soon as you can. Note that this recommendation is not to stop working and retire as soon as you can collect Social Security retirement benefits. You should still keep working if you can, want to and/or need to. Several of the most popular methods of performing the analysis are detailed below. This is the first time someone has actually crunched the numbers, to prove which annuity strategy is optimal, and then put it in a place that stays put long enough for you to thoroughly evaluate it. The truth is in the numbers, and each method shows taking retirement benefits ASAP, instead of waiting, is better financially. This is so even when assuming maximum tax rates all around. Also, when making financial plans, they ALWAYS show retirement nest eggs lasting the longest when Social Security starts ASAP (which is age 62, or 60 for survivors). It's ironic that financial advisers like to recommend waiting as long as possible to receive benefits, because it's in their best interests for their clients to take it ASAP. This is because it can invested, and/or their current investments will last longer if they spend their benefits, instead of tapping their investment portfolios. So regardless of how you look at it, more income entering their picture usually means more adviser compensation. These Social Security calculators are on the TVM Financial Tools software. You can see the results of these calculations for free on the money tools demo. Here are the assumptions used in all of these calculations: • You're eligible soon (because you're almost 62). • You have to decide between collecting "reduced benefits," this year, or waiting years for "full benefits." • These PIA (primary insurance amounts) benefit amounts came directly from an estimate statement for an average 50 year-old: • You don't need the money when you're eligible. If you take it as soon as you're eligible and spend it, then you needed it, which makes this whole debate moot. If you need it, then you should take it ASAP, even if the analysis favored waiting because you'd make a few more bucks. So this great almost half-century-long debate is only about when to start collecting Social Security retirement benefits when the recipient does not need it. • The tax rate is 28% on ordinary income. This marginal rate is usually twice as high as the average retired person's average tax bracket. This is to model the worst-case scenario, so detractors can't say, "Yeah that's the way those cookies crumble with low tax rates, but for investors in high tax brackets, waiting as long as possible to claim PIA benefits is better." • The rate of return on savings / investments is 7%. This is a pre-tax rate of return. On a non-tax qualified investment account, the amount of annual taxes is only ~0.3%. The resulting numbers favor collecting PIA benefits ASAP much more the higher this savings rate of return is. • No taxes are considered on the withdrawals from the investment account. If they were, then the results would favor collecting ASAP more, plus these taxes are less than most think. • Social Security inflation COLA (Cost Of Living Allowance) is 3% annually. • Social Security retirement benefits are included and taxed in ordinary income at 85% (the highest tax inclusion rate). Again, this worst-case scenario was modeled so detractors can't say the analysis is flawed, and thus will favor waiting as long as possible, when maximum tax inclusion rates are assumed. The lower the tax inclusion rate, or the ordinary income tax rate, the more the results favor collecting benefits ASAP. Reason #1: Government Actuaries Ensure You Can't Win Actuaries are the "rocket scientists" of the financial world, that receive "rock star" compensation. Actuarially speaking, assuming you'll live to collect Social Security retirement benefits until age 100, the total amount of money you'll receive over your lifetime will be the same, whether you start collecting at age 62 or 72. The SSA has an army of the best actuarial nerds on the planet to assure this is always so. Their primary function in this area is to ensure the total amount of benefit payments work out to be as close to exactly the same as possible, assuming a terminal age of 100, regardless of the beginning age. The deal is that you've contributed so much money, so you'll get so much back over your life expectancy. This life expectancy age is 100. In other words, you'll need to live to age 100 to be fully repaid back the FICA taxes you've paid into the SSA system. This "so much money" is "tweaked" by the actuaries in order to be exactly the same over your lifetime, after accounting for inflation, regardless of when it starts to pay out. So there's no way to "win" this money game. In 2030, average life expectancy in the US could be over 85. It's currently around 78, and increases by a few years every decade. I plan on making it to over 150, so the SSA, and my little defined benefit pension plan people, are going to hate me big time! That's an average number, so that means millions of above-average Americans will be alive, and still collecting always-increasing with inflation Social Security retirement benefits, well past age 100 in another decade or two (instead of just over 100,000 today). Every 100,000 people over age 100 collecting Social Security retirement benefits cost the system ~$150M a year, or ~$2B per decade. So when there are 10M instead of 100k centenarians, the Social Security system will be paying out ~$17B a year, or ~$200B per decade - just for them. This puts an unbearable, and always increasing, strain on the system. This is mostly because the rate of population growth has been cut by more than half since the system started. Back then, they assumed that there would be several workers paying the FICA taxes needed to pay current retirement benefits to one recipient. Now it's only about three, and in a couple decades it will probably be less than two. So that's just not going to work. This is also because back in the 60's when the SSA was created (the modern version with Medicare - the first retirement benefit check was sent out in 1940), most recipients croaked before age 80. So the system was set up to only pay full retirement benefits for about 15 years on average. They never "fixed" any of that, even after they've known about all of these problems since the mid-80's. So since then, all of the input factors have dramatically changed for the worse. But the amount of money in benefits the SSA pays out in retirement and disability benefits have remained the same. Being a "life extensionist," I'm an example of their worst nightmare. If I make to age 150, then the SSA will have paid me around three times more money than I've paid into the system in FICA (Federal Insurance Contribution Act) taxes. This is why SSA actuaries have to use such a high terminal age. Go to this page on the SSA's website, to see some of this actuarial calculus. The image below is the bottom-line from this webpage. Where the lines meet the bottom is this magic terminal age of 100: You just can't do that. So the whole deal is a colossal failure that's so far past unsustainable, there's not enough words in the dictionary to describe it. It all boils down to our fearless leaders being too lame to even think about touching this "Holy Grail of American politics" (AKA the "Third Rail of American politics"). So as you can see, there is no way to "win" by extending your Social Security start year. But there is a way to lose (see Reason #2). This is the usual answer given in the consumer-level media: "You'll get a ton more money by waiting, because the longer you wait, the higher your benefits!" This reasoning can be dismissed out of hand, just because it ignores cost of living inflation. Here's an example of estimated monthly retirement benefits for an average 50 year-old in 2010: Start at age 62 and receive reduced benefits of $1,021 This seems like huge differences, and is the basis for the usual naive arguments. But look at the inflation-adjusted benefits at age 67 and 70, assuming 3% Consumer Price Index inflation: Start at age 67: $1,236, or a 21% difference So the real difference is immediately cut in half when you account for just the average rate of inflation. As you probably know, your own personal living expense inflation rate has been much higher than the government's reported CPI numbers. For some, several times as high. Anyone keeping track of health care expenses (which rapidly become one of the biggest items in your family budget when you're over age 60) has known that just this set of items increases more than 10% annually, and probably will forever. Here are the numbers at 6% inflation: Start at age 67: $1,072, or a 5% difference So given the actual inflation rate of an old person's budget makes it so there's virtually no difference in "real" money gained by waiting to collect retirement benefits. So when it comes to how much of your living expenses Social Security will actually pay for in the future, it's a lot less than expected. Why is this basic time value of money concept ignored by most everyone that writes online / in the newspaper, and talks about it on TV / radio? Because these "financial experts" rarely crunch numbers. Most don't understand number crunching even if you hand-held them through each step of the process. We know because we dealt with one once on a relevant project. She is one of the top personal finance authors, and said, "I don't understand this stuff, I'm not a numbers person. Just give me the bottom line." Unbelievable! These are the people you'd expect to scrutinize every detail of every calculation. So taking financial advice from a money guru that's not a "numbers person" is like taking advice from a doctor that's clueless about diagnosing. You can't trust them to do much more than regurgitate what they think you want to hear. Why they get to be on TV and in the media is just because they look and sound good, not because they've used logical facts to perform any of the hard work required to arrive at the actual bottom lines needed to give meaningful advice. Our advice is to just ignore them all, and then do your own homework. The next scenario is a simple time value of money concept - saving it all, and then seeing what happens long-term. Let's look at the numbers assuming you didn't need the money at age 62, but you took it anyway and saved it all at a 7% rate of return (if you realized an 7.3% taxable rate, then that's about the same as 7% non-taxable these days). In other words, you'd set up a non-qualified investment account at a local discount brokerage office, have all of your monthly Social Security retirement paychecks automatically deposited into it, you'd never make any withdrawals, and all of the other assumptions stated above applied. If you started collecting at the beginning of the year when you turned age 62, then you'd have around $3,360,000 at the end of the year you turned 100. The present value (PV) of all of the benefit payments is ~$240,000. If you started collecting at age 67, then you'd have ~$3,336,000 at 100. The PV is ~$238,000. If you started collecting at age 70, then you'd have ~$3,257,000 at 100. The PV is ~$233,000. As you can see, you'll have the most money (PV) if you took it ASAP. The longer you wait, the less you'll have. Isn't it interesting how the actuaries did their thing so you'd end up with almost exactly the same amount of money at age 100? This is what they get paid the big bucks for, so it should not be a surprise that they just did their jobs well. Next, let's look at the scenario of saving retirement benefits collected from age 62 to 66, and then spending down these invested benefits starting when you turn 67. These savings are systematically withdrawn from age 67 to age 100. This is the blue area. This is being compared to retirement benefits starting at age 67. This is the orange area. Blue area: If you saved all of the money from age 62, then you'd have ~$61,000 at age 67. You'd then get an annual income of around $3,300 at age 67, until age 100, from these savings. This income stream from the savings grows at 3% annually (the assumed CPI inflation rate), runs out at age 100, and is added to the PIA that started at age 67 (when you stopped saving and started spending your benefits). This graph shows the difference in retirement incomes: The blue area is above the orange area. This shows that you'd have more retirement income if you started taking benefits at age 62 and saved it all. Then you'd stop saving and start spending monthly Social Security benefits at age 67. The income stream from the savings is then added to that. Benefits that started at age 67, plus the income stream from the savings account (blue area), is more than the monthly retirement benefit starting at 67 (orange area) in all years. So if what you want is maximum income starting at 67 (or older), then waiting doesn't achieve that goal. If you can average more than 7.3% on savings, then you'd have even more than just breaking even (as the blue area of the chart above shows). The following chart shows the same scenario as above, but age 67 has been changed to age 70: You'd have more income if you received benefits at 62, and then invested rather than spent them, from age 62 to 70. So no matter how you look at it, the conclusion is the same: The actuarial nerds at the SSA have this money game rigged so the amount of money you'll get is about the same, no matter when you start collecting it (unless Reason #2 below applies). Reason #2: You're Old, So You'll Probably Croak The older you are, the lower the chances are that you'll see another year. This is especially so if you're already worn out from working hard for a living, and don't do much other than sit on the couch watching TV consuming the normal American diet comprised mostly of yummy poison. If you decide to wait as long as possible because you want the higher monthly income stream later, then you'll probably pass away before you see any money at all. So you should start collecting ASAP. This is because if you do pass away, then you would not have collected any money (or a survivor gets a reduced amount). If you take it ASAP, then the money you'll have received until you pass away is money that you would have missed out on if you decided to wait (and a survivor gets about the same). So on one hand you'd get nothing, and on the other hand you'd at least get something. Something is always better than nothing. A Social Security calculator was not made to show the difference in incomes if you were to croak, because it should be obvious how this works. For an example, you can look at the age 80 row on the first two Social Security calculator demos. Croaking at age 80 resulted in having these amounts saved: Starting benefits at age 62: $562,000, present value: $155,000 There is also the argument that having this increased income from age 62 to 67, or from 62 to 70, can be used to purchase better health care, food, quality of life, assistants, and exercise equipment; all of which can dramatically help prevent croaking. For $1,000 a month, you can buy more trips to the doctor, medications, vitamin supplements, healthier food, someone to help you with basic functions (like changing clothes, doing dishes, and showering), gadgets that will call 911 if you fall and can't get up, a gym membership, personal trainer, physical therapists, paying premiums on Medicare supplements, etc. and so forth. So putting this money to good uses like this, even if you "don't need it," could easily extend your life by a decade or more. Bottom line: Again, it makes no financial sense to wait. Even if you don't need it, you should still take your Social Security benefits ASAP, and then dedicate it all to a life extension program, safety net, insurance, realizing a higher quality of life, assistance with mundane chores, etc. If you don't, then the chances of croaking before getting your money paid back goes up every day. Every day you don't live to age 100 is more of your FICA tax money that the SSA does not give back to you. If that doesn't register, then try this: Every day you do not live, the government gets to keep more your hard-earned tax dollars. In other words again, both the sooner you take it, and the longer you live, the more you'll be able to "stick it to The Man." Reason #3: Any Future Changes to the System Won't be Good for You Brilliant politicians could just continue to screw things up, and then just decide to not pay anymore. If you keep watch on such issues, then you know that the system is very much broken. For going on three decades, our fearless leaders have all just "kicked the can down the road" for the next administration to deal with, totally ignored all "fixes" that will actually save and/or extend the program, and then minimized news of this disaster from getting into the public domain - all so they won't have to take the heat and "waste time" dealing with it. They want you to just go back to playing video games, watching Dancing with the Idols, or whatever it is you like to do that keeps you sedated and oblivious to reality. I know, because I offered them "fixes" that would completely and permanently repair the system, that both parties would sign into law in a New York minute, and was totally ignored. In case you didn't know, there is no Social Security Trust Fund. There was once upon a time, but that turned into a complete accounting farce back in the early 80's. All current benefits are paid from current tax income. In other words, your FICA taxes are not being set aside and then saved in a savings account just for you to withdraw from when you become of age. Your tax dollars are flowing into the Treasury, and then just flowing right back out in the form of benefit checks to current recipients. Performing a search of the top ten "respectable" websites in April '15 on when Social Security will become bankrupt, resulted in an average year of 2040. You read that correctly: Unless they "fix it," which they won't, then given current assumptions; Social Security will stop paying benefits, and/or drastically reduce them, starting around 2035. Somewhere between the draconian scenario of our fearless leaders just saying, "The current self-inflicted Great Debacle is just too much, so Social Security is kaput, and won't pay retirement or disability benefits anymore," and their usual rosy scenario; is probably the reality. Which are strings of reduced benefits from temporary patches like, "Social Security benefits increasing at inflation minus 1%." This means if annual inflation (as measured by the CPI) is 3%, then instead of your benefits going up by 3% like they do now, they're only going to go up by 2%. This adds up to major bucks over the years. If this happens, then the longer you wait, the more you'll lose. Then these losses compound annually too. So every year, the ability to pay your living expenses will decline if you depend on SSA benefits. The only way to fix the disastrous imbalance in projected revenue vs. promised benefits, is to cut benefits (taxes can't be increased enough, because then they'd be even higher than in France). The only levers to pull to fix the problem are to lower benefits directly, reduce or eliminate the annual COLA, eliminate / increase the payroll tax income threshold, needs-test benefits, raise the tax inclusion rates, increase the FICA tax rate, or increase retirement benefit payout ages (again). "Rich people" will be up in arms if their FICA taxes go up in any way, and "poor people" will be up in arms if benefits are reduced in any way. So the chances of politicians having the spine to take on these two groups of people in a way that actually solves any problems are slim to none, and Slim left town. It's a no-win-scenario, because whomever proposes change will be booted out of office (because political campaign money will flow to those that seek power by promising no change). So our fearless leaders just choose to ignore these massive budget-breaking problems by doing nothing. They'll all be dead, or long forgotten, when the actual bankruptcy begins; so doing nothing is the most pragmatic solution that everyone finds acceptable. This is just normal everyday life in American politics (and is what I call, "a species-level failure" - everyone wants all they can get now, regardless of the repercussions on future generations). Using private investment accounts is also a disastrous idea (proved by the Great Debacles from 2007 to 2009 that caused the Great Meltdown which caused the Great Recession). These harebrained ideas will just result in much less money coming into the system to pay benefits, and should be avoided. So Social Security just going bankrupt will happen someday. No matter how you look at it, the forecast is for much less and not more, over time. So you need get as much as you can while you can. The longer you wait, the less you'll get. There could also be an actual war, hyperinflation, natural disaster, resource depletion, or another round of self-inflicted Great Debacles; where there's just no Social Security benefits of any kind for anyone for years, if ever. None of these realistic forecasts will result in you receiving more money in Social Security retirement benefits by waiting either. So you should take it all the very first month you can. Bottom line: Again it makes no financial sense to wait. You should drink the punch while it's being served because they're going to be serving less and less of it as time goes by. Reason #4: A Bird in Hand is Better than Two in the Bush Something may happen where you'd need the money. So if you waited, and then needed more money, then all you'll get is the monthly payment if you change your mind, fill out the forms, and wait for it to kick in (which could be months). On the other hand, if you collected ASAP and saved it, then it will be there for you to tap whenever you need it. If you spent your benefits, that means you didn't need to spend other resources, so they will be more available to tap later if and when needed (Reason #5). If you spent your benefits, with no other resources to not tap, then that usually means that you were able to cut back on working to earn the income needed to survive. So this will add years, to decades, to your life. Bottom line: Again, it makes no financial sense to wait. Take the sure thing when you can (bird in hand), even if it looks like you can get more later (two birds in the bush). The moral of this old story, is when you drop the bird in hand because you think you can grab the two in the bush, all three will get away, and then you'll have nothing. If you just let the two in the bush go, you'd at least have the one bird in hand (to eat). Another old story is "the dog with two bones:" A dog with a bone comes across a pond. He looks into it. What he sees is a smaller dog with a bone in his mouth. So he thinks, "All I have to do is drop my bone, and then grab the other dog's bone, and then I'll have two bones!" Then, of course, when he drops his bone, it sinks and is gone forever, leaving him with no bones at all. So it's always best to not do that. Just be happy that you have one bird, or one bone, don't get greedy; and then move on counting your blessings that you have something to eat at all. Reason #5: You Can Leave Other Resources Alone Longer By using your Social Security income as soon as it becomes available to help meet your living expenses, you can leave other income-producing investments alone to grow longer. You can also invest other sources of income instead of having to spend them. Also, the longer you can leave them alone, the more aggressive you can be with your investment portfolio asset allocation mix, which means you can hold more of the types of asset classes that beat taxes and inflation over time. This means you'll make more profits over time, which means higher retirement income later, when you really need it. Even if the numbers showed waiting beat collecting ASAP, the amount of money gained with this would be insignificant compared to the growth of an untapped, well-balanced, Diversified, investment portfolio over a five-to-ten year period. The following charts show how much capital it would take to replace the same five (from age 62 to 67), and then eight years (62 to 70), of missed Social Security income. This is then compared to having the same amount of capital that grew untouched (because you didn't need to tap into savings if you start collecting retirement benefits at age 62):

The orange area of the chart above shows a need of ~$43,000 at age 62 to replace the after-tax income that you could have received if you started collecting benefits from 62 to 67. In other words, it shows waiting until age 67 to collect benefits, and tapping existing investments to generate the benefit income lost from age 62 to 67 (that was needed to pay living expenses). The $43,000 is depleted at the end of age 66, and then the difference between benefits from starting at 62, compared to starting at 67, is added back to the investment account at 67. Where it starts going back up again, is the benefits being invested into the same original fund, instead of being spent. The blue area shows this same $43,000 growing at 7% tax-free untouched. This line is above the others, which means collecting ASAP beats waiting in every year. Bottom line: Again it makes no financial sense to wait. This is because if you would have taken benefits at age 62 instead of 67, then you would have not needed to tap $43,000 of your other investment accounts to provide this retirement income. Leaving this money alone would have resulted in ~$24,000 more money at age 100, compared to tapping it. If capital gains and dividend taxes were applied to the withdrawals of this investment account, then the difference would have been greater (because more initial investment capital would have been needed. The more capital withdrawn, the more taking benefits ASAP beats waiting, shown below). The green area of the chart above shows a need of ~$73,000 at age 62 to replace the income you would have received if you started collecting benefits at 62. In other words, it shows waiting until age 70 to collect benefits, and then tapping investments to generate the Social Security benefit income lost from age 62 to 69. This $73,000 is depleted at the end of age 69, and then the difference between benefits from starting at 62 compared to starting at 70 is added back to the investment account. The blue area shows $73,000 growing at 7% tax-free untouched. If you would have taken benefits at 62 instead of 70, then you would have not needed to tap $73,000 of your savings. Leaving this money alone would have resulted in ~$104,000 more money at age 100. As you can see, the longer you wait, the less money you'd have at the end of the money game (waiting until age 67 resulted in ~$24,000 less, and waiting until 70 resulted in ~$104,000 less). Bottom line: Again it makes no economic sense to wait. Conclusions No matter how you look at it - either by using common sense, like knowing that if you croak then you won't get paid; or by analyzing the numbers using facts, logic, and math - you'll win on all fronts if you collect Social Security benefits ASAP. You'll also lose on all fronts more and more the longer you wait. There's no scenario whatsoever that results in having more money in any year by waiting (not even working and paying high ordinary income taxes on 85% of the benefits). So there's zero chance or way that you'll be better off by waiting, using this logical boring stuff called arithmetic. If your Social Security benefits are lowered because of earned income via "working," then your benefits are raised back up later to make up for it when you reach full retirement age. So again actuarially, if you live that long, you'll still get the same amount of money back. So you should collect ASAP even if you're working. This page on Social Security's website explains that. Waiting is similar to having too much taxes withheld from your paycheck, and then getting a big tax refund the next year. You're just giving the government an interest-free loan while giving up the use of this money in the meantime. But unlike annual income taxes, if you croak, then you don't get this loan repaid. Just like the life insurance companies and their fixed annuities and defined benefit pension plans - the government is hoping you'll croak, so they won't ever have to pay you anything. So as you can now see, this use of your money for dozens of millions of people, adds up to extremely large amounts over time. So our advice is to always take the "reduced benefits" the very first month you can, usually around your 62nd birthday. Survivors should always start collecting at age 60. If you have debt, then you should take Social Security ASAP, and then use your benefits to pay it down until it's eradicated. These exact same concepts and math can also be applied to the debate over when to start taking defined benefit pension plans and fixed annuities. It's almost never better to wait because it's the exact same thing using the exact same actuaries using the exact same math to perform the exact same bottom-line comparisons. The numbers will always work out this way, because these entities employ the best minds in the financial world to crunch the numbers to ensure this is always so. So there's zero way to "win" in this "zero-sum money game." Here's the bottom line on most all deals where someone is offering you a stream of money (the definition of an annuity): "We'll start giving you $X in monthly income for life today, but hey if you wait Z years, then you can get this awesome deal making much more money, with $X + $Y!" Here's the catch: The entity paying this income stream really really wants you to wait as long as possible, and take $X + $Y. Mostly, because they know you'll probably croak, in which case, they won't have to pay you X, Y, or anything at all, in most cases; just like Social Security, defined benefit pension plans, and annuitized annuities. But mostly it's all because the way the math works out, as you've read above. They make the most money from their deal when you wait. You make the most money from their deal when you take it ASAP. Then in addition to the numbers working out like this, there are several Real World risks that all point to taking whatever income streams entities offer you ASAP. It's just as simple as that. This is why you're always reading that you should wait to take Social Security. It's because "they" want you to, because they have to pay back much less of your money over time like that. Here's the bottom line with Social Security: Look at the demo and any year's numbers over age 75 and compare. The differences are always going to be so insignificant, that they're essentially always the same. Even if waiting resulted in more money, it would be an insignificant amount, compared to the risks taken to get it. There's two scenarios that bottom line the risks: First, humanity's biggest miracle ever occurs, and the government magically "fixes itself." That's about as likely as my dead grandmother rising from the dead, sprouting wings, and flying me to the pot of gold at the end of a rainbow. It just ain't gonna happen, so get over hoping for any of that. Next, everything just continues as is. Which is the more likely scenario? Thereyago, it's just as simple as that. So get it while you can, as early as you can, because it's only going to get worse. After you do the math, then you'll see it's most always best to take lifelong income streams immediately when offered. Miscellaneous The money spreadsheet that made these calculations / tables of numbers / graphs is part of the TVM Financial Tools software product. You can see the results from these calculations on the free TVM tools demo. After you buy it, then you can input and run your own benefit numbers and compare these scenarios. Download the Social Security Administration's free AnyPIA benefit calculator to see your actual benefit estimates. It's more accurate than commercial benefit calculators, because only Social Security knows your lifetime of earnings and FICA contributions. So it's best not to use or rely on any Social Security retirement benefit predictions from any source other than "the horse's mouth." From the MoneyGuidePro Goalware Review Their whole Social Security module is stupid, wrong, bogus, deceptive, insidious, and is a big of a fat lie as it gets. When making a real financial plan, using real financial planning software, and fresh numbers directly from Social Security, all you need to do is run two of the exact same scenarios. In one, input getting Social Security at 70, and in the other, input 62. The plan using 62 will be better every time. It only looks better with MGP (and other goalware) because that's what goalware is programmed to. It's programmed to lie with bogus numbers because that's how BD Reps sell more life insurance company products. It's just as simple as that to understand. Unless you're taking advantage of a loophole, that Social Security just closed, and goalware stills runs along as if it was still there; there is no scenario that will ever result in making more money by waiting. It's just not possible, because it's the main function of their actuaries to ensure this is always so. That's the truth. Everything else is just a lie designed to sell you something that's bad for you. Go to the Social Security Administration's website Articles about Social Security |

Financial Planning Software Modules For Sale (are listed below) Financial Planning Software that's Fully-Integrated Goals-Only "Financial Planning Software" Retirement Planning Software Menu: Something for Everyone Comprehensive Asset Allocation Software Model Portfolio Allocations with Historical Returns Monthly-updated ETF and Mutual Fund Picks DIY Investment Portfolio Benchmarking Program Financial Planning Fact Finders for Financial Planners Gathering Data from Clients Investment Policy Statement Software (IPS) Life Insurance Calculator (AKA Capital Needs Analysis Software) Bond Calculators for Duration, Convexity, YTM, Accretion, and Amortization Investment Software for Comparing the 27 Most Popular Methods of Investing Rental Real Estate Investing Software Net Worth Calculator (Balance Sheet Maker) and 75-year Net Worth Projector Financial Seminar Covering Retirement Planning and Investment Management Sales Tools for Financial Adviser Marketing Personal Budget Software and 75-year Cash Flow Projector TVM Financial Tools and Financial Calculators Our Unique Financial Services Buy or Sell a Financial Planning Practice Miscellaneous Pages of Interest Primer Tutorial to Learn the Basics of Financial Planning Software About the Department of Labor's New Fiduciary Rules Using Asset Allocation to Manage Money Download Brokerage Data into Spreadsheets How to Integrate Financial Planning Software Modules to Share Data CRM and Portfolio Management Software About Efficient Frontier Portfolio Optimizers Calculating Your Investment Risk Tolerance |

© Copyright 1997 - 2018 Tools For Money, All Rights Reserved